i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

11

Overall, the Hong Kong economy will do well in 2014 and 2015 and its stock market will continue its

upward trend. For now,

i

Capital still expects the Hang Seng Index to test the 50,000 mark for the

long-term

. For the

medium-term

,

i

Capital retains its outlook at a range of 21,000 to 33,000. It is the

short-term outlook that is less clear. On balance,

i

Capital retains its

short-term

outlook of the Hong

Kong stock market with a range from 20,000 to 30,000 but the index has equal chances of moving

either way. See Stop Press for the latest.

A.2. (iv). China on the move

On 18 Mar 2004,

i

Capital started an exclusive section on China, an immensely important, huge, and

complex nation. As our managing director described it, the emergence of China is an event that

happens only once in a millennium. Tracking its fast emergence and understanding its development

will therefore be useful not only for investors but also for businessmen and management. This

exclusive series “China on the move” started with “A Brief History of China”, made up of 8 parts,

started with the Xia Dynasty (

夏朝

) and rounded up by examining Deng’s reforms.

China Today

China today is the world’s most exciting, dynamic, and successful economy. What drove China’s

phenomenal growth in the past few years ? In the previous parts of China Today, we examined her

economic structure, sources of growth, the current conditions, and her future.

Employment and Economic Growth

China’s economy is in a goldilocks condition, not too hot and not too cold. Hence, the People’s Bank

of China is not tightening its monetary policy nor loosening it. It will just ensure that there is sufficient

liquidity in the economy to facilitate a stable growth. What is a stable growth rate for China ? Currently,

it is around 7-7.5%. This growth rate is largely determined by employment. The relationship between

employment and economic growth has been well established by economic theory. The Phillips Curve

and the Okun’s Law are two of the more well-known theories that explained the relationships between

inflation and unemployment rates and unemployment and output.

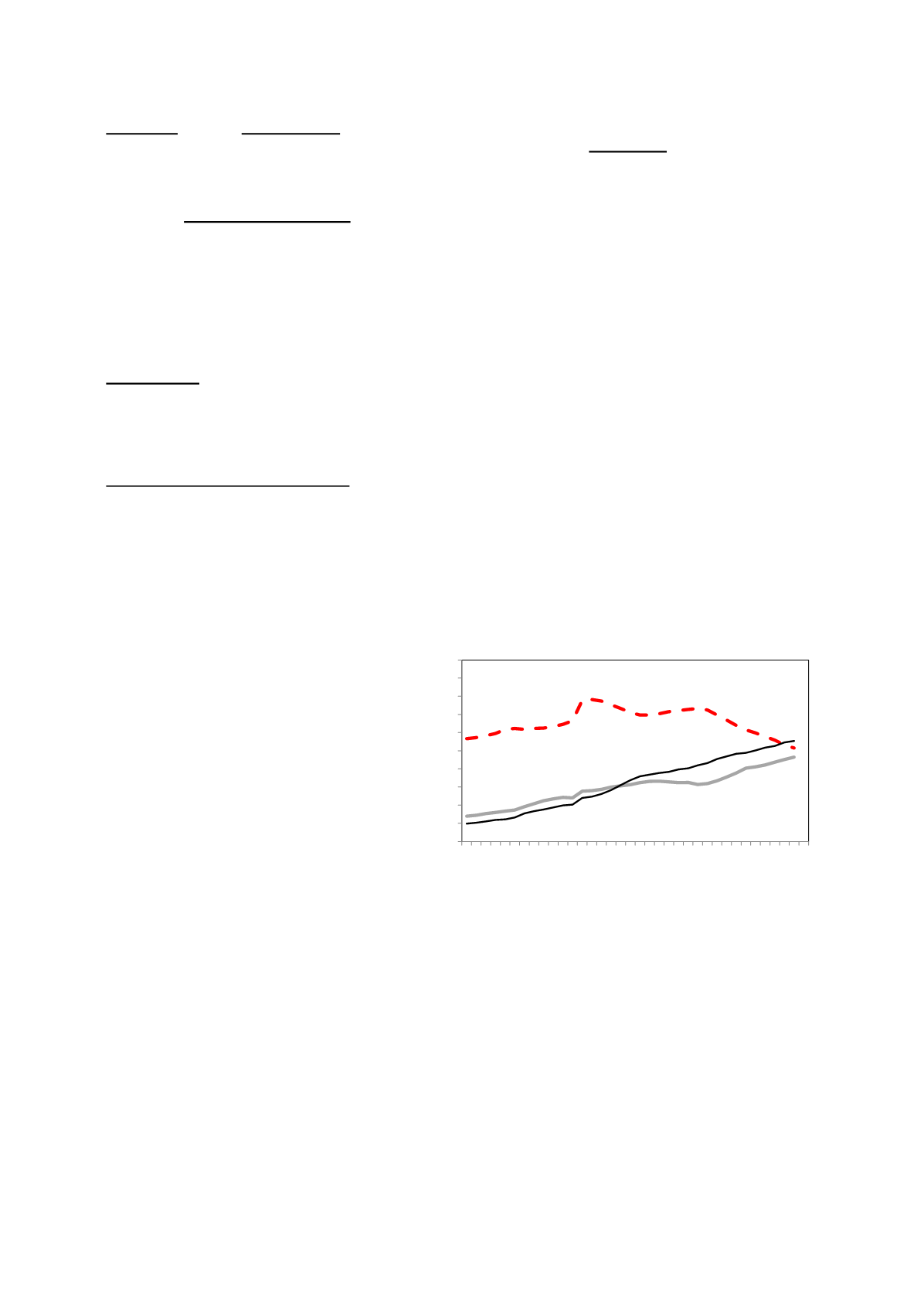

Since China’s economic reforms began in

the late 1970s, the relationship between

economic growth and employment can be

categorised into a few phases. First, from

1978 to the early 1990s when China’s

economy expanded at a rapid rate, the

employment elasticity was around 0.25,

meaning every one percentage point (ppt)

of GDP growth is associated with

employment growth of 0.25 ppt. Then,

between the early 1990s to the time just

before the US-led global financial crisis in

2008, China’s employment elasticity fell

due to rapid urbanisation which saw surplus labour in the rural areas moving into the industrial and

services sectors. In recent years, following progress made in the industrial structure, the employment

elasticity has turned up again. Increased demand for various services saw the services sector

surpassing the agriculture sector in 2011 to become China’s largest employer – see

figure 1

.

Now, for every ppt that China generates in growth, 1.3 mln to 1.5 mln jobs are created, up from 1.0

mln a few years ago. Every year, there are 12 mln new entrants entering into the labour market. To

absorb these new entrants, China’s premier Li Keqiang said that the economy must grow by at least

7.2% in order to cap the urban unemployment rate at around 4%. In other words, 7.2% is the minimum

growth rate that the Chinese government will tolerate in order to maintain a stable employment

condition. This compares with the target of 8% growth prior to 2008.

China is a big country with immense geographic and cultural diversity; she is home to 56 official ethnic

groups. Maintaining social stability is always the top priority of the Chinese government. Hence,

creating sufficient employment opportunity every year is one of the most important tasks for China’s

policymakers. Below are the major challenges that the Chinese government is facing currently in its

efforts to create a stable employment condition.

First, although the services sector has become the largest provider of employment in China, the

primary sector still provides about 35% of employment to the Chinese people, which is close to 260

mln people. As the urbanisation rate accelerates, more and more people will be moving to the urban

0

50

100

150

200

250

300

350

400

450

500

1978 1982 1986 1990 1994 1998 2002 2006 2010

mln persons

Figure 1: Employed Persons

Primary Industry

Secondary Industry

Tertiary Industry