i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

9

Going forward, with prices rising and auction clearance rates remaining at high levels, the total value

of housing finance commitments should continue to rise in the coming months although the

approaching holiday season could dampen this trend somewhat.

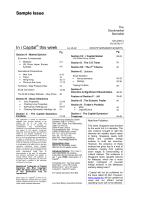

Table 16: Housing Finance

(% change)

From Sep 2013

From Oct 2012

Total dwelling commitments

4.1

21.4

Owner occupied housing

1.7

17.2

Construction

0.5

16.7

Purchase of new dwellings

0.3

11.0

Purchase of established dwellings

2.4

17.5

Investment housing

8.2

28.8

In Dec, the leading indicator of employment fell for the second consecutive month and cyclical

employment declined for the seventh consecutive month. However, it is still too early to tell whether

employment will grow more slowly than its long-term trend rate of 1.2% per annum over the coming

months. The leading indicator of employment is expected to remain sluggish in the months ahead

amid weakening consumer confidence and signs of a slowdown in economic activity after the post-

election pickup.

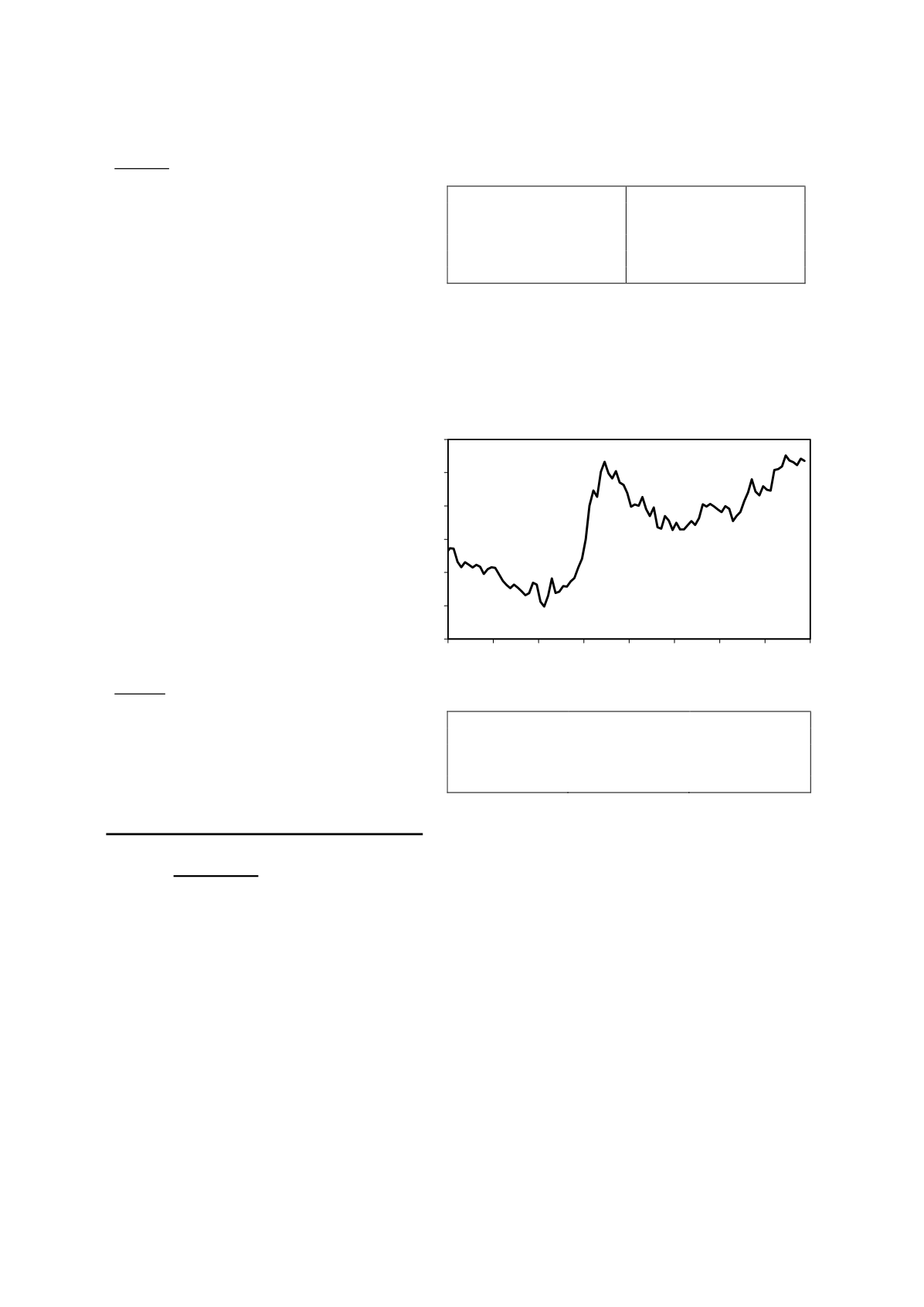

The seasonally adjusted unemployment

rate edged up by 0.1 ppts in Nov while

the

participation

rate

remained

unchanged at 64.8% – see

table 17

.

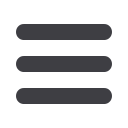

Despite the rise in the unemployment

rate, total employment increased by

21,000 as both full-time and part-time

employment picked up from the previous

month. However, the labour market is

still extremely soft with the number of

people looking for full-time work

remaining at its post 2008 US-led global

financial crisis level – see

figure 9

.

Table17: Labour Indicators

Oct 2013

Nov 2013

Change

Unemployment rate

(%)

5.7

5.8

+0.1 ppts

Participation rate

(%)

64.8

64.8

0.0 ppts

Employment

(‘

000 persons

)

11,638.9

11,659.9

21.0

Full time

8,092.4

8,107.9

15.5

Part time

3,546.5

3,552.0

5.5

A.2. International Perspectives

A.2. (i). New York

No matter how one looks at it, US monetary tightening is near. There are really no good reasons to

hold it back or to postpone it anymore. The ISM manufacturing report for Nov was very strong. Not

only at the headline number but also at the key components’ level. New orders, exports and most

importantly, employment jumped.

Remember these are forward looking indicators, which was soon followed by an unexpectedly strong

coincident indicator, Nov’s employment data. Not only was the jobs gain better than expected but the

unemployment rate plunged to 7%. In the past, this positive figure would be offset by a fall in labour

participation rate. Lo and behold, the labour participation rate actually rose in Nov. The message was

unambiguous from Nov’s job report.

Now, the final nail in the debate about the Fed’s monetary tightening has been hammered in. The US

politicians have reached agreement on the US budget deficit reduction. The budget negotiators

announced an agreement to ease automatic spending cuts by US$63 bln over 2 years and reduce the

deficit by US$23 bln, ending a multiple-year cycle of fiscal circus. The bipartisan budget accord would

set US spending at about $1.01 trillion for this year and would reduce US budget deficit by around

US$20 bln to US$23 bln. Not a big deal but the fact that the Democrats and Republicans in Congress

were able to agree breaks the destructive mindset of selfish narrow interests and decision-making

which have been driven by crisis and panics.

250

300

350

400

450

500

550

2006 2007 2008 2009 2010 2011 2012 2013

Figure 9: People looking for full-time work

Jan 2005 - Nov 2013

'000