i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

8

Table 13: Bank Lending

Year-on-year % change

Amount Outstanding (trillion Yen)

Sep 2013

Oct 2013 Nov 2013

Nov 2013

Total

2.2

2.3

2.4

407.2

Major banks

1.9

1.7

1.8

198.6

Regional banks I

3.1

3.1

3.3

164.5

Regional banks II

0.9

1.9

2.0

44.1

Japan’s current account posted a deficit of 127.9 bln Yen in Oct, the first deficit in 9 months – see

table 14

. This was due mainly to a bigger deficit in the trade balance, which is likely to stay large in

the next few months due to high imports of fuel for the winter.

Table 14: Current Account Balance

(

100 mln Yen)

Oct 2013

Sep 2013

Oct 2012

Trade balance

-10,919

-8,748

-4,513

Exports

58,332

57,172

49,495

Imports

69,251

65,921

54,007

Services

-3,137

-1,015

-3,155

Income

13,615

16,279

12,483

Current transfers

-838

-643

-607

Current Account

-1,279

5,873

4,208

Money supply, M2, continued to rise at a record pace, up 4.3%, year-on-year, in Nov. The uptrend in

monetary expansion reflects the Abe government’s efforts to bring about a 2% inflation rate. As the

inflation rate still falls short of the target, the uptrend in monetary expansion should continue in the

months ahead.

Europe

The European Central Bank kept its benchmark interest rate 0.25%. Underlying price pressures are

expected to remain subdued over the medium term and the pace of economic recovery remains weak.

Hence, monetary policy should stay accommodative to support a stronger economic recovery.

Australia

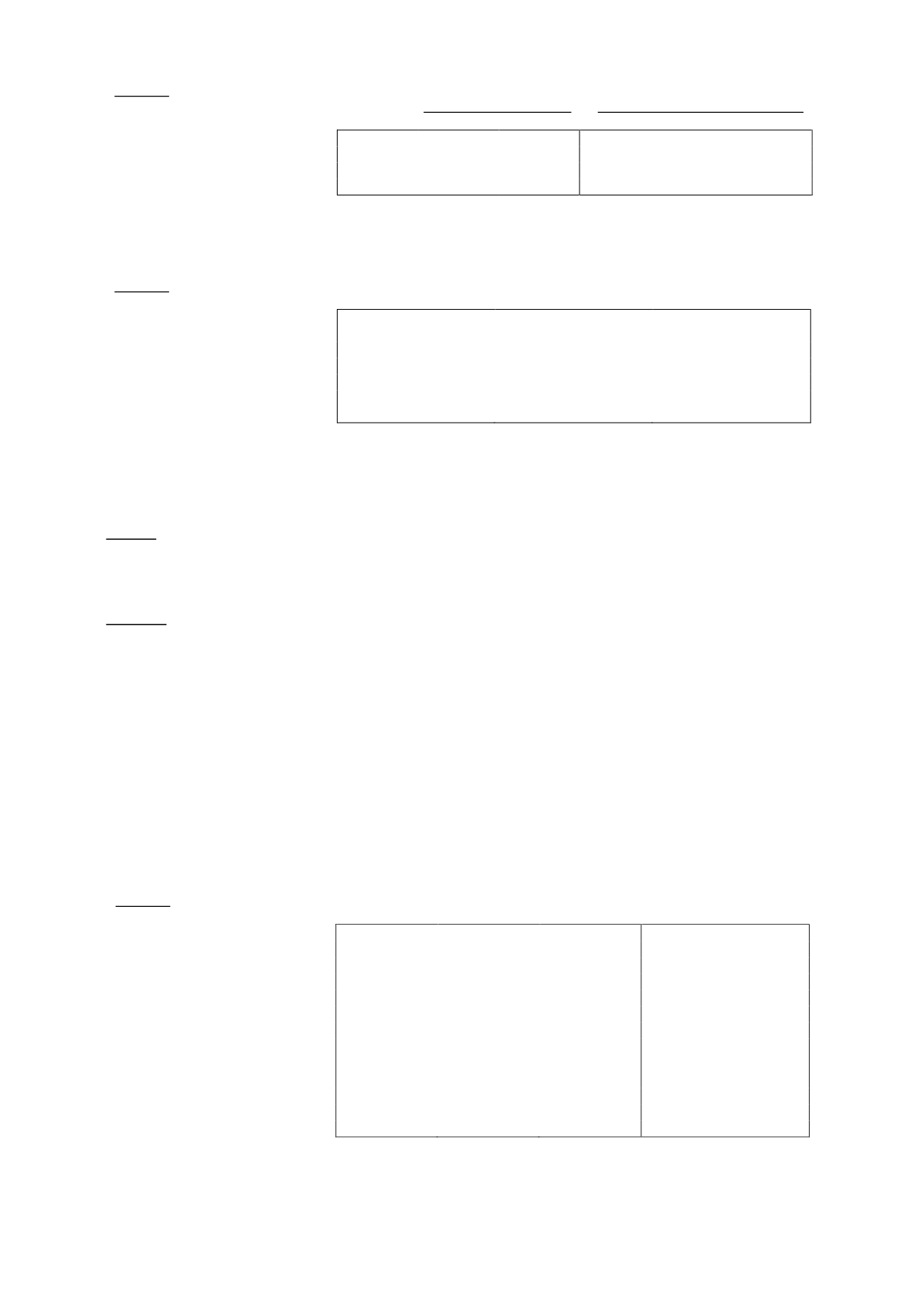

The seasonally adjusted Performance of Construction Index (PCI) increased by 0.8 ppts in Nov to

55.2%. This was the second consecutive reading above the 50% critical value that separates

expansion from contraction and signals its strongest performance since Apr 2010.

The improvement largely reflected a sharp increase in new orders, particularly in the housing and

engineering sectors, along with a rise in deliveries from suppliers – see

table 15

. Although building

activity in the four major sectors moderated somewhat, capacity utilisation rate rose to its highest level

since Dec 2010. However, the rate of contraction in selling prices increased again despite rising cost

burdens, suggesting builders remain under significant pressure.

Survey respondents noted that demand was strengthening along with an increase in tender

opportunities. House builders reported that customer enquiries had been sustained at high levels.

However, tight credit conditions and a lack of public sector tenders were cited as the main constraints

on activity.

Table 15: PCI (%)

Sep 2013

Oct 2013

Nov 2013

Monthly Change(ppts)

Overall PCI

47.6

54.4

55.2

+0.8

Activity

51.9

57.3

54.6

-2.7

Houses

61.5

65.3

62.0

-3.3

Apartments

57.7

66.2

57.9

-8.3

Commercial

43.7

52.6

52.9

+0.3

Engineering

49.0

52.7

52.5

-0.2

New orders

50.8

54.3

58.5

+4.2

Employment

40.6

52.5

50.3

-2.2

Deliveries

44.4

52.0

57.9

+5.9

Input prices

67.3

72.1

71.3

-0.8

Selling prices

41.9

48.9

44.9

-4.0

Wages

55.2

57.4

55.7

-1.7

Capacity

67.6

70.8

72.0

+1.2

In Oct, the total value of housing finance commitments rose 4.1%, month-on-month, and 21.4%, year-

on-year. As shown in

table 16

, the rise largely reflected rising finance commitments for the purchase

of established dwellings and investment housing. Year-on-year, the total value of housing finance

commitments for both owner occupied and investment housing continued to surge, rising 17.2% and

28.8% respectively .