i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

3

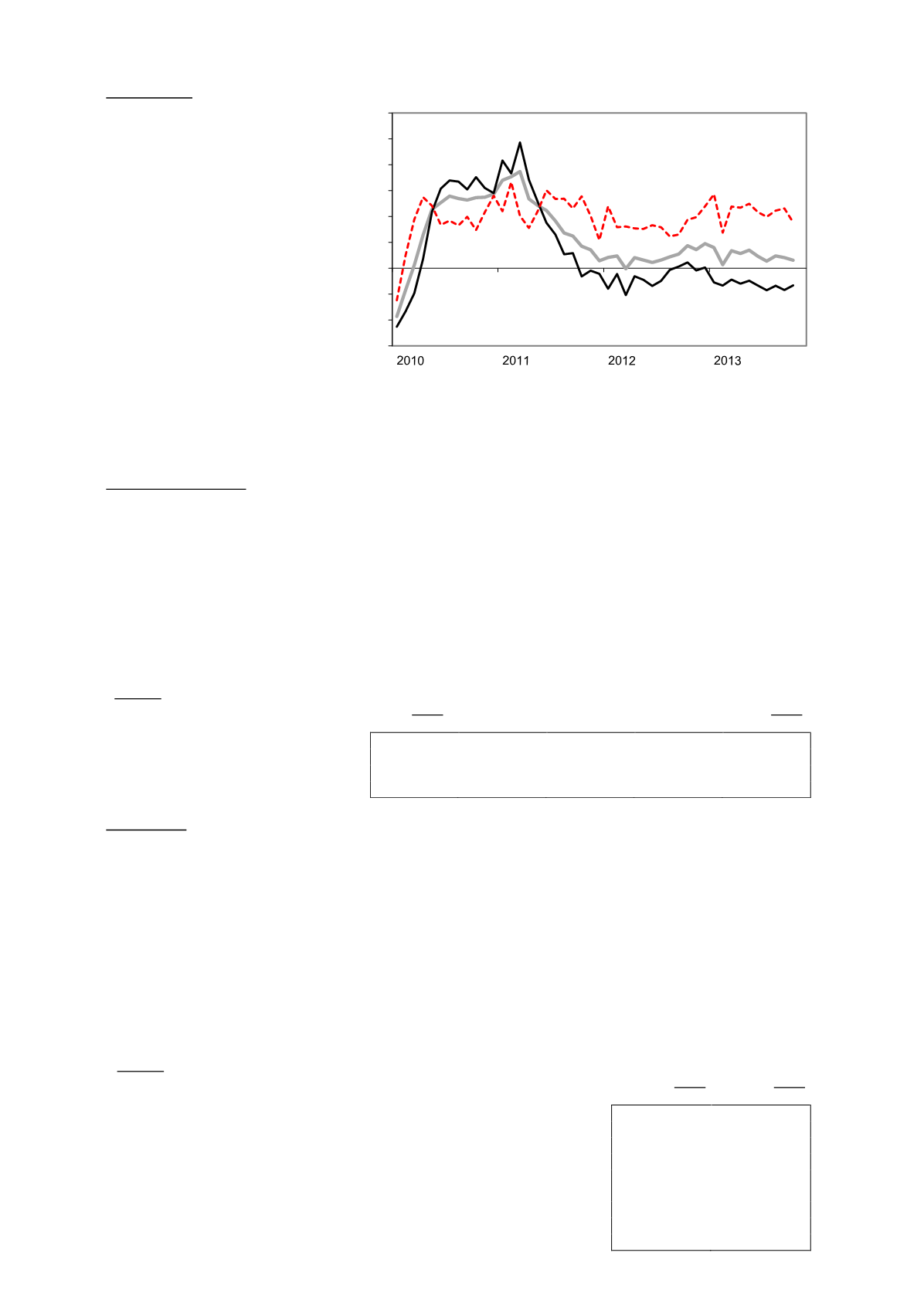

Employment

In Oct, employment in the

manufacturing

sector

grew

marginally by 0.01% from Sep.

Year-on-year,

employment

growth slowed to 0.6% – see

figure 2

. Employment in the

export-oriented

industries

decreased for the 10th month in a

row, down by 1.3%. On the other

hand, employment in the

domestic-oriented industries rose

by 3.5%, although this marked

the 45th consecutive month of

increase, it represented the

slowest growth in eight months.

The average salaries and wages per employee fell 1.4%, month-on-month, and increased steadily by

9.3%, year-on-year, to RM2,675 in Oct. Going forward, employment in the export-oriented industries is

likely to stay subdued since there is no clear indication of a significant pickup in external demand for

Malaysia’s manufactured products.

Industrial production

In Sep, the year-on-year growth of industrial production accelerated slightly to 1.7%. As shown in

table 2

, the rebound was largely led by the manufacturing and electricity sectors. Positive contributors

to the higher manufacturing growth include E&E products, machinery, textile, chemical products and

rubber. Natural gas production increased robustly by 12.8% year-on-year, but this was largely offset

by a similar magnitude of decrease in crude oil production. Output growth from the export-oriented

industries outpaced that of the domestic-oriented industries for the first time in eight months, rising by

3.6% and 2.8%, year-on-year, respectively.

The mild rebound in manufacturing output is encouraging. Going forward, industrial production is

expected to pick up amid recovering demand for manufacturing products.

Table 2: Industrial Production

(y-o-y % change)

2013

2013

Jul

Aug

Sep

Oct

Jan-Oct

Total

7.5

2.8

1.0

1.7

2.4

Manufacturing

5.4

5.2

2.4

3.3

2.8

Mining

15.4

-4.6

-4.3

-3.6

0.5

Electricity

6.1

5.1

3.9

4.8

5.3

Sales value

In Oct, the manufacturing sales value accelerated slightly to a year-on-year growth of 1.9% from a

three-month-low of 1.5% in Sep – see

table 3

.

Positive contributors to the sales value growth are: motor vehicles, electronic related products,

television and radio related apparatus and computer. Industries posted lower sales value growth

included refined petroleum products, industrial chemicals, semi-conductor devices, vegetable and

animal oils manufactured products and rubber re-milling. Sales value of the export-oriented industries

slip 0.2%, year-on-year, while sales value of the domestic-oriented industries climbed by 7.2%. The

strong sales value of the transport and electronic products industries are encouraging. However, the

weak performance of the export-oriented industries is worrying.

The cumulative sales value during Jan-Oct 2013 slipped 0.7% from the same period in 2012.

Table 3: Sales Value

(y-o-y % change)

2013

2013

Oct

Jan-Oct

Veneer sheets & plywood

-5.7

4.8

Refined petroleum products

-6.7

-3.3

Basic iron & steel products

6.2

-7.0

Plastics in primary forms & of synthetic rubber

3.2

3.4

T.V & radio receivers, sound or video recording or reproducing apparatus etc.

26.0

11.6

Semiconductor devices

-10.7

-12.4

Industrial gases

76.1

24.3

Computers & computer peripherals

7.9

-8.5

Motor vehicles

339.2

69.2

-6

-4

-2

0

2

4

6

8

10

12

%

Jan 2010 to Oct 2013

Export-oriented industries

Domestic-oriented

industries

Overall

Figure 2: Manufacturing Employment

(y-o-y)