i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

7

The annual growth rate of money supply, M2, at the end of Nov slowed slightly to 14.2% from 14.3%

at the end of Oct. Monetary expansion is exceeding the government’s 13% target to ensure a stable

economic growth.

Japan

Japan’s economic growth in 3Q 2013 was revised downwards to a SAAR of 1.1% from 1.9%

estimated last month. This was due mainly to a slower increase in private non-residential investment –

see

table 10

. Nevertheless, Japan’s economy is on course to achieve

i

Capital’s forecasted growth

range of 1.0-2.0% in 2013. Going forward, the sales tax increase in Apr 2014 could temporary boost

private consumption in the first quarter of 2014 and the 5.5 trillion Yen of stimulus package should

cushion the economy from the adverse impact of the sales tax hike. However, the real challenge lies

beyond the short-term outlook, which calls for serious structural reform to the Japanese economy.

Table 10: 3Q 2013 GDP – comparisons of the 1st and 2nd estimates (q-o-q, %)

Nominal

Real

1st

2nd

1st

2nd

GDP

0.4

0.3

0.5

0.3

Domestic demand

1.1

0.9

0.9

0.7

Public demand

1.4

1.6

1.6

1.4

Private demand

0.9

0.7

0.7

0.5

Private consumption

0.4

0.5

0.1

0.2

Private non-residential investment

0.4

0.2

0.2

0.0

Exports of goods and services

0.8

0.8

-0.6

-0.6

Imports of goods and services

4.5

4.5

2.2

2.2

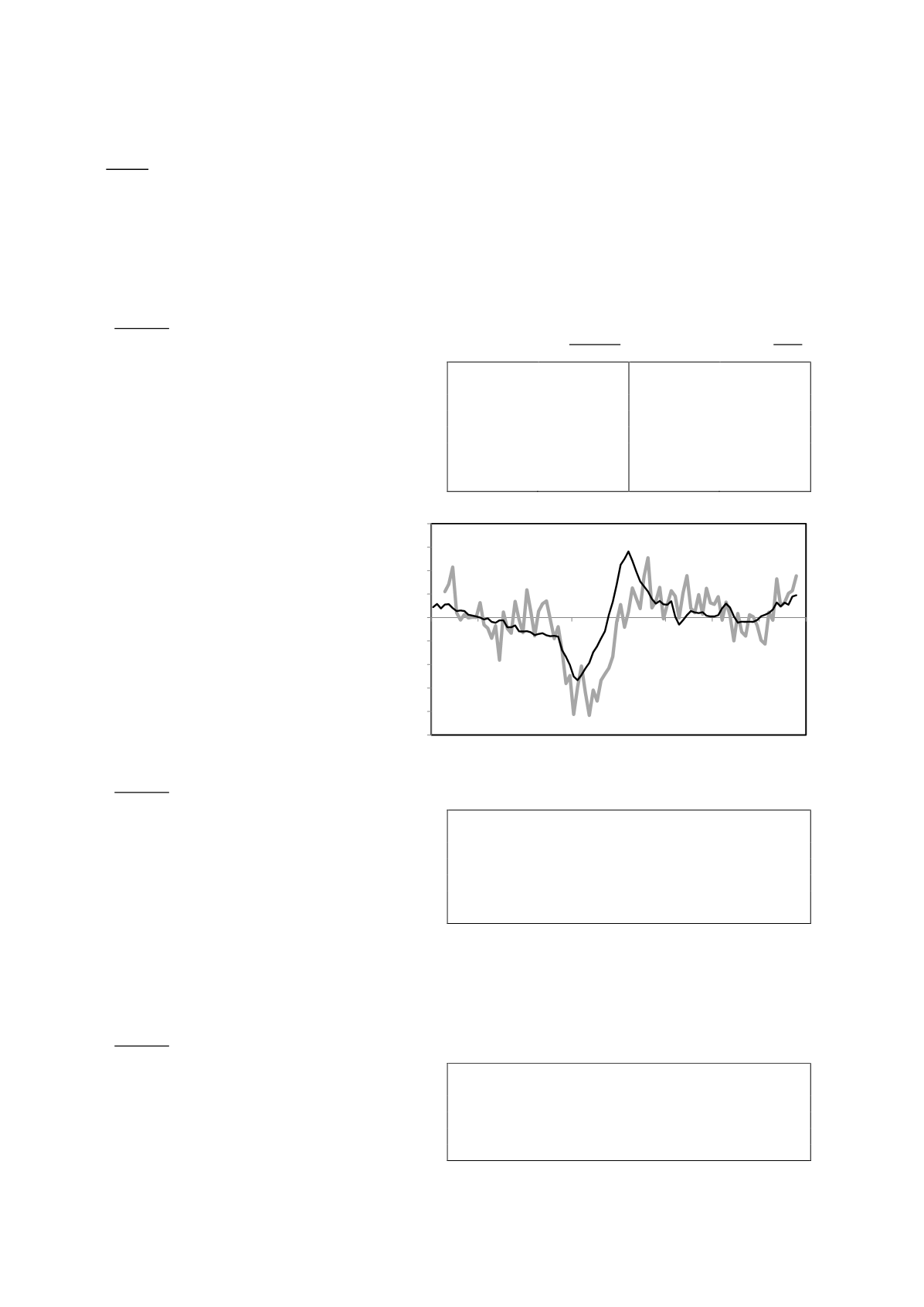

Core machinery orders in Oct rose

0.6%, month-on-month, and 17.8%,

year-on-year – see

table 11

.

Supported

by

rising

business

sentiments, core machinery orders

have risen strongly since the beginning

of the year – see

figure 8

. This was

underpinned by the fiscal pump

priming under the second arrow of

Abenomics. The 5.5 trillion Yen fiscal

stimulus package to offset the impact

of the sales tax hike should continue to

support investment spending in the

months ahead.

Table 11: Machinery Orders

(% change)

Month-on-month

Year-on-year

Total

-4.6

24.6

Private sector

7.0

20.7

Excluding volatile orders

0.6

17.8

Manufacturing

-0.2

21.9

Non-manufacturing (excluding volatile orders)

11.5

15.1

Government

-26.2

24.1

From overseas

-16.0

29.7

In Nov, the domestic corporate goods price index (DPI) rose 0.1%, month-on-month, and 2.7%, year-

on-year – see

table 12

. The weak Yen has caused inflation at the producer level to rise above 2% for

the 4th month in a row. The consumer price index should follow in the similar direction, albeit at a

slower pace.

Table 12: Domestic Corporate Goods Price Index

(% change)

Month-on-month

Year-on-year

All commodity

0.1

2.7

Manufacturing industrial products

0.0

1.9

Agriculture, forestry, & fishing products

1.4

2.2

Minerals

0.0

4.1

Electric power, gas, & water

-0.5

10.8

Scrap & waste

5.5

38.1

Bank lending continued its steady expansion in Nov, rising 2.4% from a year ago. As shown in

table

13

, loans from all categories of banks rose steadily in Nov. This is a positive development as it

indicates a broadening of economic growth.

-50

-40

-30

-20

-10

0

10

20

30

40

2006 2007 2008 2009 2010 2011 2012 2013

%

Figure 8: Core Machinery Orders and Business Conditions

(y-o-y)

Core Machinery Orders

Business Conditions

Composite Leading Index

Jan 2006 to Oct 2013