i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

5

Professional & business services

-3

7

-3

Education & health services

14

30

40

Leisure & hospitality

-1

49

17

Government

7

-14

7

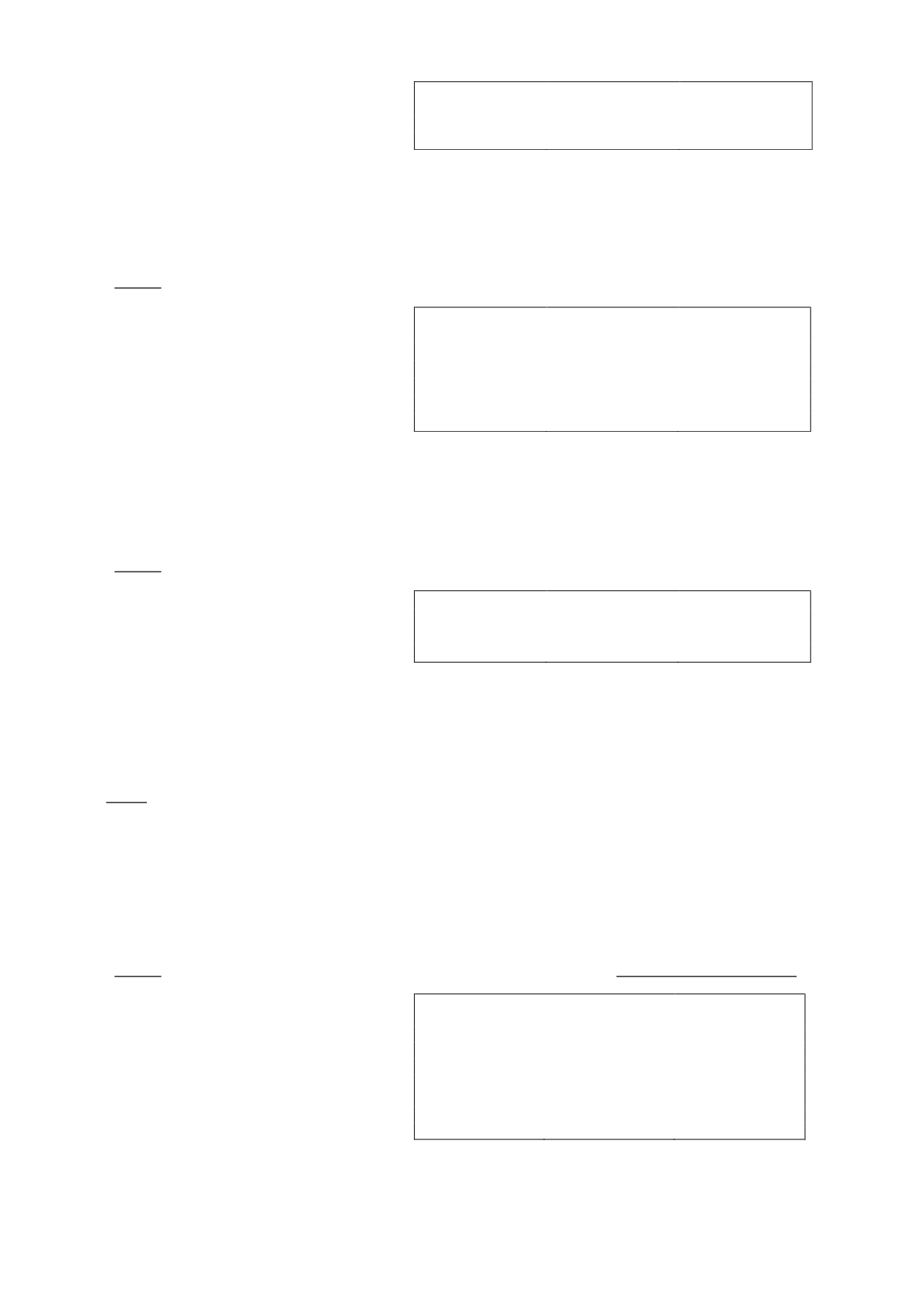

In Oct, personal income fell US$10.8 bln, or 0.1% from Sep, to a SAAR of US$14,290.1 bln. The fall

was due mainly to a contraction in proprietor’s income – see

table 6

. Nominal and real disposable

personal income (DPI) each fell by 0.2%, month-on-month, in Oct. On a year-on-year basis, personal

income in Oct rose by 3.4%, while DPI and real DPI gained by 2.6% and 1.8% respectively. The

broad-based recovery in employment bode well for a steady improvement in income growth.

Table 6: Personal income

(change from preceding month, US$ bln)

Aug 2013

Sep 2013

Oct 2013

Personal income

74.3

64.3

-10.8

Wage & salary disbursements

41.1

25.6

9.0

Proprietor’s income

15.6

22.1

-19.7

Rental income

5.1

6.3

2.4

Interest income

-0.9

-1.0

1.2

Dividend income

-1.6

4.3

-5.3

Personal current transfer receipts

15.6

6.7

0.6

In Oct, personal consumption expenditures (PCE) rose by 0.3%, month-on-month, to a SAAR of

US$11,582.9 bln – see

table 7

. On a year-on-year basis, PCE increased by 2.8%. Meanwhile, real

PCE increased by 0.3%, month-on-month, and 2.1%, year-on-year. The savings rate in Oct fell from

5.2% in Sep to 4.8%. The steady increase in consumption expenditures reflects rising consumer

confidence over the economic recovery.

Table 7: Consumer spending

(% change from prior month)

Aug 2013

Sep 2013

Oct 2013

Consumer spending

0.3

0.2

0.3

Durable goods

1.4

-1.4

0.6

Non-durable goods

-0.2

0.6

0.3

Services

0.3

0.4

0.2

The seasonally adjusted initial claims for the week ending 30 Nov 2013 dropped by 23,000 from the

previous week to 298,000, while its 4-week moving average declined by 10,750 from the previous

week to register at 322,250. At the same time, continuing jobless claims for the week ending 23 Nov

2013 registered at a seasonally adjusted 2.744 mln, a decline of 21,000 from the previous week, while

the 4-week moving average dropped by 32,500 to 2.796 mln from the previous week.

China

The consumer price index (CPI) in Nov slipped 0.1%, month-on-month, but rose 3.0%, year-on-year –

see

table 8

. The moderation in inflation rate was due mainly to a slower increase in food prices. Non-

food prices were flat, month-on-month, but rose 1.6%, year-on-year. Excluding food and energy, the

CPI was flat, month-on-month, but rose 1.8%, year-on-year. This shows that inflationary pressures

remained benign.

In Jan-Nov 2013, the CPI rose 2.6% from the same period a year ago, way below the target of 3.5%

set by the government.

Table 8: Consumer Price Index

% change from the prior year

Sep 2013

Oct 2013

Nov 2013

Total

3.1

3.2

3.0

Food

6.1

6.5

5.9

Tobacco, liquors & articles

-0.2

-0.2

-0.2

Clothing

2.3

2.4

2.0

Household apparatus & maintenance services

1.4

1.5

1.3

Medicines, medical care, & personal articles

1.1

1.0

1.0

Transportation & communications

-0.2

-0.6

-0.5

Recreational, educational & cultural services

1.9

2.5

2.8

Residence

2.6

2.6

2.6

China recorded another big trade surplus of US$33.8 bln Nov, with exports posting a record high of

US$202.2 bln, up 12.7% from a year ago. Meanwhile, imports rose 5.3% to US$168.4 bln. Such

favourable performance was supported by firm demand from China’s major trading partners, with

exports to the US, EU, South Korea, ASEAN, and Russia all posting double-digit increases. This

should help to ensure a stable GDP growth in 4Q 2013.