i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

2

Section A :

Market Opinion

This section is based on a top-down/market-timing approach. In each

issue of i

Capital

®

, Capital Dynamics will look at the major economic

variables, locally and abroad, major equity markets plus some

technical indicators before reaching its conclusion for the KLSE

Composite Index. In other words, Section A should be read in toto.

A.1. Economic Fundamentals

Data to be expected (Date in parentheses is actual release date).

Dec 16 – 22

Dec 23 – 29

Malaysia

(18 Dec) Nov consumer price index

US

(16 Dec) Nov industrial production

Nov personal income

(17 Dec) Nov consumer price index

Nov personal consumption

(18 Dec) FOMC meeting

Nov new home sales

(18 Dec) Nov housing starts

Nov durable goods orders

(19 Dec) Nov leading index

21 Dec initial claims

(19 Dec) Nov money supply

(19 Dec) Nov existing home sales

(19 Dec) 14 Dec initial claims

(20 Dec) 3Q GDP – 3rd estimates

Japan

(16 Dec) Dec

tankan

Nov consumer price index

(18 Dec) Nov external trade

Nov retail sales

Nov industrial production

Nov employment report

Nov household spending

Nov housing starts

China

(18 Dec) Nov house prices

A.1. (i). Malaysia

External trade

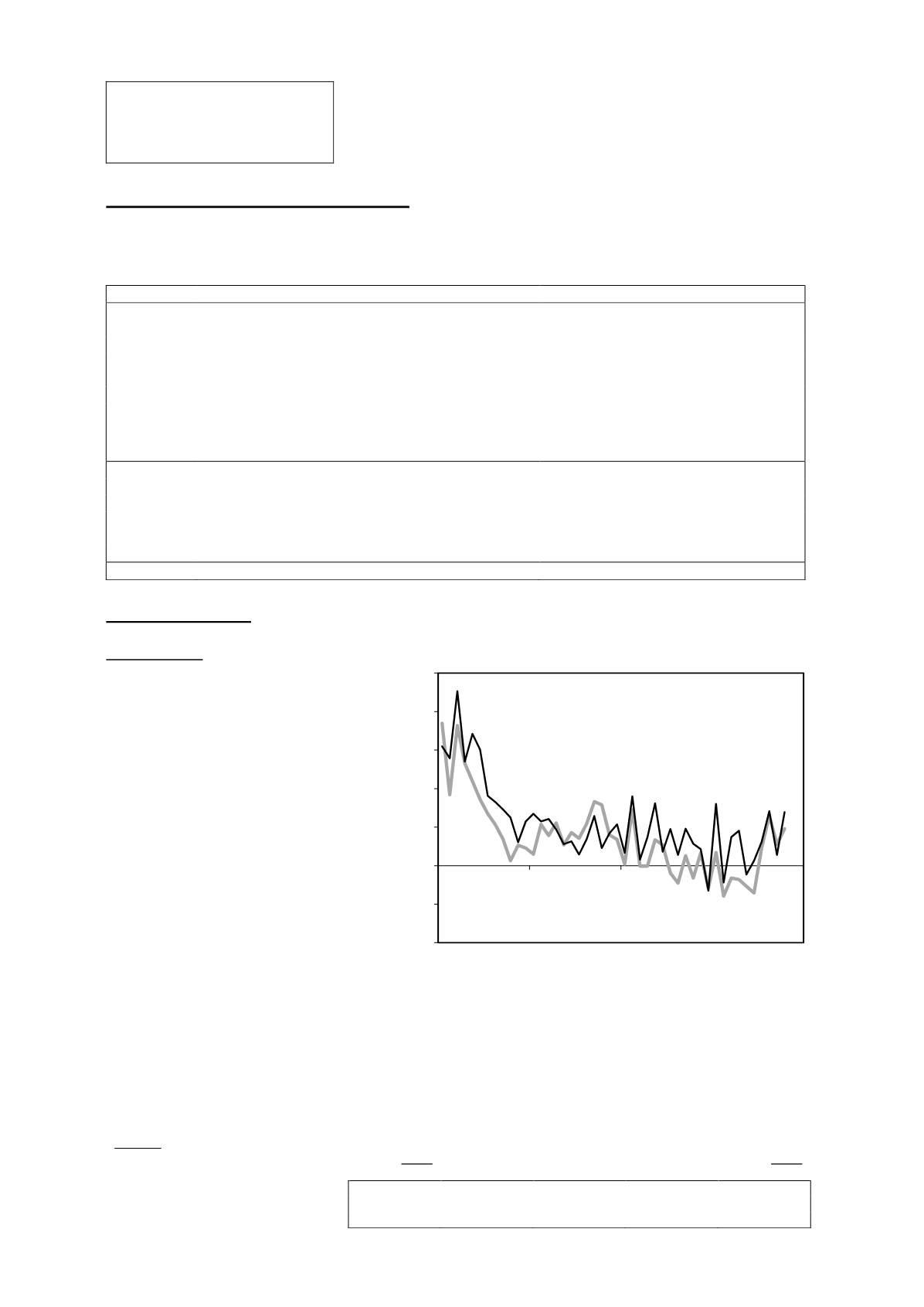

In Oct, exports rose by 9.6%, year-on-

year, to RM67.11 bln – see

figure 1

.

Import growth accelerated to 13.9%,

year-on-year, at RM58.88 bln. The

trade surplus narrowed slightly to

RM8.23 bln.

Year-on-year, the exports of major

commodities grew by 6.2%, while the

growth of manufactured exports surged

to the highest pace this year, at 11.2%

– see

table 1

. This was mainly led by

higher exports of electrical and

electronic (E&E) products, petroleum

products, liquefied natural gas and

crude petroleum. Negative contributors

include palm oil products.

On the other hand, the year-on-year imports of consumption, capital and intermediate goods all went

up in Oct. The imports of intermediate goods were supported by parts & accessories of capital goods

and fuel & lubricants.

Manufactured products and total exports in the first 10 months of 2013 posted the first positive growth

since Feb 2013. Going forward, Malaysia’s exports are expected to be supported by the strengthening

of the economies of China and Europe.

Table 1: Exports

(y-o-y % change)

2013

2013

Jul

Aug

Sep

Oct

Jan-Oct

Major commodities

3.8

15.2

5.5

6.2

-0.6

Major manufactured products

4.1

10.6

4.0

11.2

0.8

Total exports

4.6

13.0

5.6

9.6

0.9

-20

-10

0

10

20

30

40

50

2010

2011

2012

2013

Figure 1: Exports and Imports

(y-o-y)

%

Imports

Exports

Jan 2010 to Oct 2013