i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

4

Tourist arrivals

In Sep, total tourist arrivals reached 2.09 mln, up 5.7% from Aug. Year-on-year, it rose 6.1%, the

strongest growth in six months. Arrivals from regional countries such as China, Japan, Vietnam and

Taiwan continued to post double-digit year-on-year growth in Sep. One exception was Thailand,

whose tourist arrivals have declined on a year-on-year basis since Jan 2013. Tourists from Singapore,

Indonesia and China accounted for a combined 68.9% of total tourist arrivals in Sep.

In Jan-Sep 2013, total tourist arrivals climbed 3.3% from the same period last year. As 2014 has been

declared Visit Malaysia Year, a series of promotional activities is expected to lead to more tourist

arrivals next year.

A.1. (ii). International

US

In the second estimate, real GDP growth in 3Q 2013 was revised substantially upwards to a seasonally

adjusted annual rate (SAAR) of 3.6%.The upward revision primarily reflected an upward revision to

private inventory investment – see

table 4

. Meanwhile, private consumption grew at a slower rate than

estimated previously. Economic data for 4Q 2013 remains largely favourable. Hence,

i

Capital

maintains its forecast that the US economy will grow in the range of 2-3% for the whole of 2013.

Table 4: 3Q 2013 GDP

1

(% change, annual rate)

2

(percentage points)

Growth

1

(q-o-q)

Contribution to growth

2

2Q 2013

Advance

estimate

3Q 2013

2nd

estimate

3Q 2013

2Q 2013

Advance

estimate

3Q 2013

2nd

estimate

3Q 2013

Real GDP

2.5

2.8

3.6

-

-

-

Nominal GDP

3.1

4.8

5.6

-

-

-

Personal consumption expenditure

1.8

1.5

1.4

1.24

1.04

0.96

Gross private domestic investment

9.2

9.5

16.7

1.38

1.45

2.49

Exports

8.0

4.5

3.7

1.04

0.60

0.50

Imports

6.9

1.9

2.7

-1.10

-0.30

-0.43

Govt consumption & investment

-0.4

0.2

0.4

-0.07

0.04

0.09

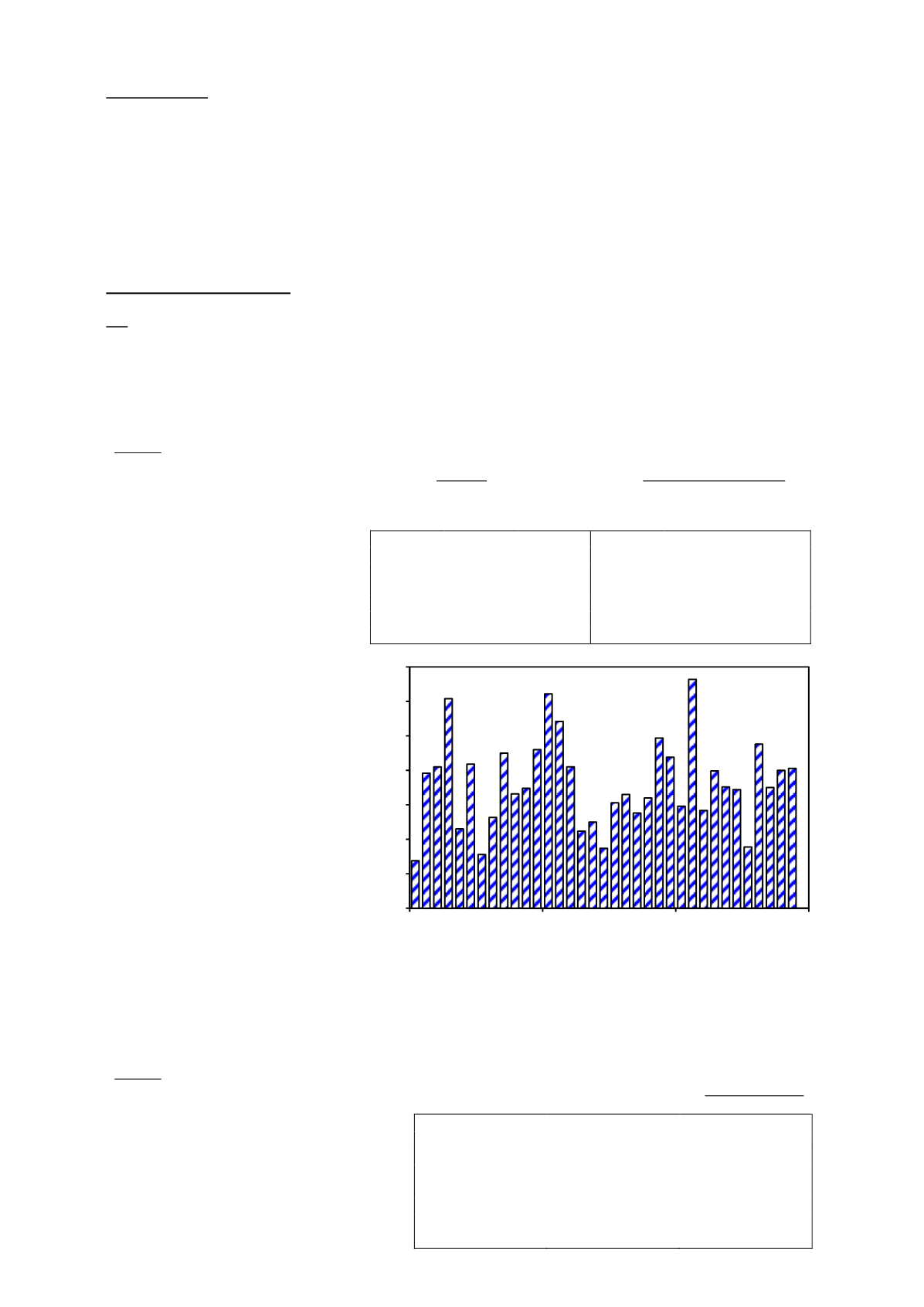

The labour market strengthened

substantially in Nov, with the non-

farm payrolls increasing by

203,000. In addition, revisions to

Sep’s and Oct’s numbers resulted

in an additional gain of 8,000 in

employment

than

previously

reported – see

figure 3.

As shown

in

table 5

, job gains in Nov

continued to come largely from the

service-producing

industries.

However, the goods-producing

industries have been contributing

steadily as well, signaling an across

the board recovery.

The unemployment rate in Nov fell by 0.3 percentage points (ppts) from Oct to 7.0%, the lowest level

in 6 years. Meanwhile, the average hourly earnings rose by 4 cents to US$24.15, while the average

workweek edged up by 0.1 hour to 34.5 hours.

The Nov employment report was better than expected. The Federal Reserve is expected to

commence its monetary tightening exercise before 2014.

Table 5: Non-farm Payrolls

(’000)

Monthly change

Sep 2013

Oct 2013

Nov 2013

Non-farm employment

175

200

203

Goods-producing industries

29

31

44

Construction

17

12

17

Manufacturing

8

16

27

Service-providing industries

13.9

183

152

Retail trade

23.3

45.8

22.3

Transportation and warehousing

36.9

3.1

30.5

Information

2

4

-1

0

50

100

150

200

250

300

350

2011

2012

2013

'000

Figure 3: Non-farm Payrolls

Jan 2011 - Nov 2013

(month-on-month)