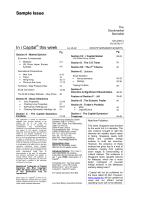

i

Capital

®

Volume 25 Number 17

Capital Dynamics Sdn Bhd

10

The US economy is certainly normalising, with the exception of its monetary policy.

i

Capital now

expects this to kick in. The next Federal Open Market Committee meeting is on 17-18 Dec. For the

short-term

, although the festive season is near,

i

Capital is retaining its worried outlook of the

NYSE at a range of 1,550 to 1,880. See Stop Press for the latest. As

i

Capital has advised

previously, while it remains bullish for the NYSE over the longer-term, the NYSE is priced for

perfection. For the

medium-term

,

i

Capital retains its bearish outlook at a wide range of 1,450 to

1,900 to incorporate the likelihood of a major correction on the NYSE.

i

Capital still expects the

NYSE to make new highs as part of its

long-term

outlook, and its tentative target for the S&P 500

remains as 2,000 or even higher.

A.2. (ii). Tokyo

The short-lived hype of Abenomics is showing its age. Japan’s 3rd quarter GDP expanded at a much

slower pace than initially estimated. Despite the sales tax hike in Apr next year, private demand was

weaker than expected. In another development that would further derail Abenomics, support for

Japanese prime minister Shinzo Abe slid in opinion poll after opinion poll after opinion poll. This is in

response to Abe’s ruling coalition steamrolling through Japan’s parliament a secrecy act that critics

are convinced would muzzle the media and allow the Japanese government to hide misdeeds. The

definition of official secrets is also broadened.

Support for Mr Abe’s government fell 13.9 percentage points (ppts) to 54.6% in a poll by Japan News

Network, the lowest since he took office. A survey by news agency Kyodo showed support for Mr

Abe’s cabinet fell 10.3 ppts to 47.6%, its first drop below 50% in a Kyodo poll since Mr Abe began his

second term. About 82% of the respondents to the Kyodo poll, conducted recently, wanted the

secrecy act — which many have likened to Japan’s harsh authoritarian regime before and during

World War 2 — to be revised or abolished. The Peace Preservation Act of 1925 was ultimately used

against ordinary people in Japan’s prewar years and during World War 2. It is not surprising that

thousands of demonstrators protested near the parliament and there have been criticisms from a

broad swathe of media and intellectuals. The law provides for public servants or others with access to

state secrets to be jailed for up to 10 years for leaking them. Journalists and others in the private

sector convicted of encouraging such leaks could get up to five years for using “grossly inappropriate”

means to solicit the information. If the rating continues to fall and touches 30%, past patterns show the

government will collapse within a year.

It would not be surprising that Abenomics fails precisely because of Abe. As

i

Capital advised, the

Nikkei cannot rise just based on a falling Yen.

i

Capital retains its bearish

short-term

outlook of the

Nikkei Average at a range of 10,000 to 16,000. See Stop Press for the latest.

i

Capital also retains its

bearish

longer-term

outlook of the Nikkei as Japan will disappear before she gets poor.

A.2. (iii). Hong Kong

The short to medium term direction of the Hong Kong stock market is a fight between the US and

China. No,

i

Capital is not referring to the lopsided quarrel over the air defence integrated zone. It is

referring to the differing economic conditions in the two giants.

China’s economy has very clearly soft landed some quarters ago. Answering the question of whether

China’s economic growth will accelerate or be of a steady state-type is more difficult. The recent batch

of economic indicators is however more mixed in relation to this question. The headline GDP number

shows a stable, steady state-type of economic growth. The manufacturing sector and fixed asset

investment are emitting the same message too. A look at China’s inflation rate would also lend

credence to such an outcome. The property sector, in particular, property prices are still in a state

where further tightening steps are needed. Figures for retail sales and exports show that growth in

these 2 key areas is picking up in pace. Overall, the verdict on China’s economy is simple. It remains

as the strongest economy in the world and the longer-term prospects are excellent.

For the US economy, its recovery is certainly gathering momentum. It is broadening and deepening.

While 2014 will be a better year, the US needs to tackle the normalisation of her monetary policy

without causing a major global disruption.

Hong Kong is caught between these two giants. Her sources of growth are very linked to China’s

economic conditions, which is a great thing to rely on. Her monetary policy is unfortunately tied to

America’s. The Federal Reserve will be tightening very soon, in 2013 and US interest rates will rise

further. The US$ will be strengthening too. These will pull up the HK$ and Hong Kong’s interest rate.

The currency and interest rate sensitive businesses of Hong Kong will be adversely affected but those

tied to China’s rebalancing will flourish.