The week of 18 August – 24 August 2016

Volume 28 Number 01

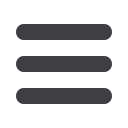

A.3. KLSE Technical Analysis

One technical indicator is shown per issue.

STOP PRESS:

The KLSE CI is above its 30-day, 50-day and 50-week moving averages. Both

its daily DMI and MACD are bullish. While the KLCI has been rising, the local

and macro-economic fundamentals have not improved. Corporate earnings are

also disappointing. In view of this, even if the US Federal Reserve does not raise

interest rate soon, the risks are high that the KLSE is vulnerable to nasty shocks.

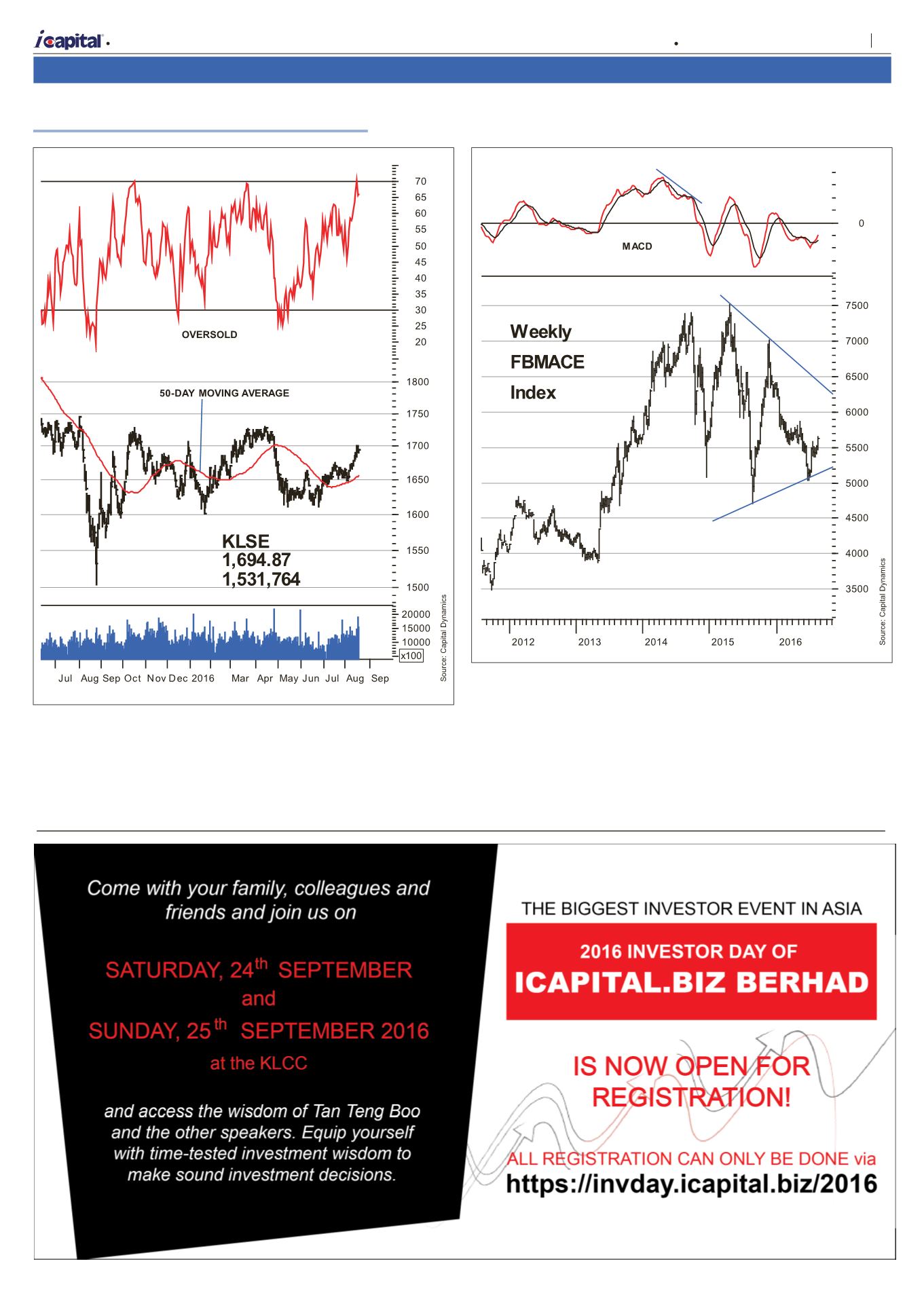

This week’s

i

Capital updates the KL weekly FBMACE Index. In 2013, the index

made a breathtaking rally - one with so much momentum that its weekly MACD

formed a bearish divergence in the process. The rally could not sustain and the

index succumbed to a 61.8% retracement. It staged a sharp rebound before

plunging again. It repeated its roller-coaster ride to form a symmetrical triangle.

With a rebound from the support line and a bullish MACD, the index seems poised

for a recovery. Will the Federal Reserve be a kill joy?

A

| Market Opinion

13

Capital Dynamics Sdn Bhd