The week of 18 August– 24 August 2016

Volume 28 Number 01

A

| Market Opinion

Source:

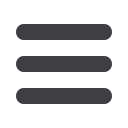

www.stats.gov.cnChina: Fixed asset investment in Jan-Jul 016 (y-o-y,%).

China

Industrial production

In Jul, industrial

production rose 6.0%,

year-on-year, returning to

the growth rates recorded in

Apr and May – see

figure

16

. While output in the

mining sector fell by 3.1%,

manufacturing and utility

sectors’ output continued

to expand steadily. Output

growth of the high-tech

industries also remained

faster than that of the

traditional industries.

In Jan-Jul, industrial

production rose 6.0% from

Table 23 Vehicle Sales

Jul

2016

mln units

Jan-Jul 2016

Jul

2016

year-on-year % change

Jan-Jul 2016

Total

1.85

14.68 23.03

9.84

Passenger

1.60

12.65 26.26

11.13

Commercial

0.24

2.04 5.52

2.41

Source:

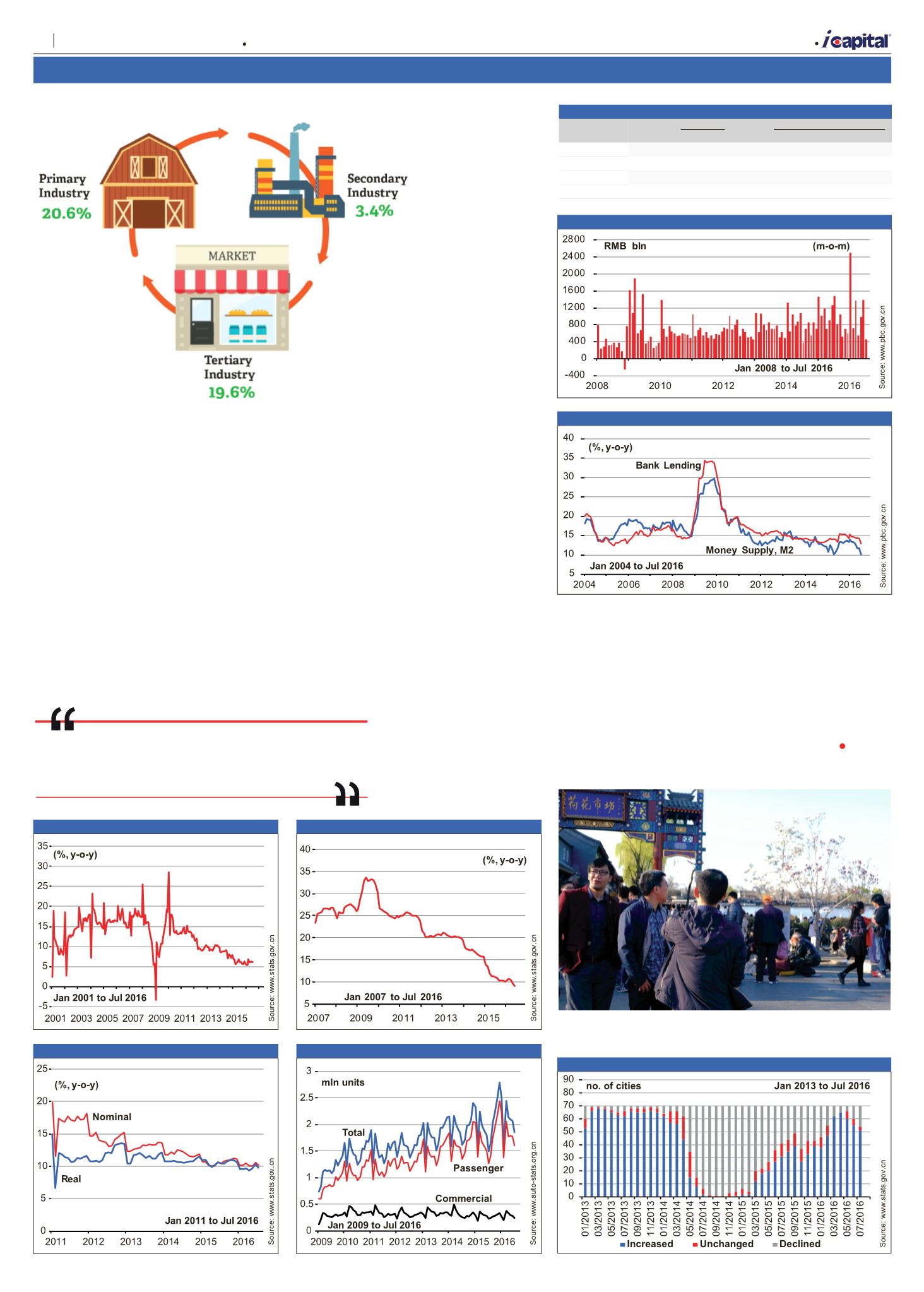

www.auto-stats.org.cnFigure 20 Renminbi Bank Loans

Figure 21 Money Supply and Bank Lending

Figure 22 Month-on-month Change in House Prices

the same period a year ago.

Retail sales

Despite growing at a

slower pace, consumer

spending remained resilient.

In Jul, retail sales rose

10.2% from a year ago. After

factoring out the price factor,

real retail sales rose 9.8%,

year-on-year – see

figure

17

. In Jan-Jul, retail sales

rose 10.3% from the same

period a year ago.

Fixed asset investment

Fixed asset investment

(excluding rural households)

in Jan-Jul 2016 rose 8.1%

from the same period a year

ago, 0.9 percentage

points slower than

the increase in

Jan-Jun 2016 – see

figure 18.

This was

mainly due to a sharp

contraction in mining

sector investment and

slowing manufacturing sector

investment. Investment

growth was mainly

supported by higher public

infrastructure investment.

Auto sales

Total vehicle sales in

Jul dropped 10.59, month-

on-month, but surged

23.03%, year-on-year,

to 1.85 mln units – see

table 23.

In the first 7 months

of 2016, auto sales rose by a

steady 9.84% from the same

period last year. Consumer

spending, although slightly

weakened, has remained

resilient – see

figure 19

.

Bank lending

Renminbi bank loans

outstanding at the end of

Jul were RMB101.95 trillion,

up 12.9% from a year ago.

New bank loans totalling

RMB463.6 bln were created

in Jul, the smallest amount

in 2 years – see

figure 20.

However, the weakness is

likely to be temporary as

China’s economic growth

remains stable.

Money supply

The annual growth rate

of money supply, M2, at

the end of Jul moderated

to 10.2%, in line with the

slowdown in bank lending

growth – see

figure 21

.

House prices

The number of cities

reporting month-on-month

decreases in house prices

rose from 10 in Jun to 16

in Jul, while the number of

cities reporting increases

in house prices fell from

55 to 51 – see

figure 22

.

Nevertheless, firm demand

is still exerting upward

pressure on house prices.

Monetary policy would need

to remain cautious.

Source: Capital Dynamics

Robust demand from local and foreign tourists has been a major contributor to

steady retail sales in China.

Figure 17 Retail Sales

Figure 16 Industrial Production

Figure 19 Vehicle Sales

Figure 18 Cumulative Fixed Asset Investment (Excluding rural households)

Despite growing at a

slower

pace

, consumer spending

remained resilient.

8

Capital Dynamics Sdn Bhd