The week of 18 August – 24 August 2016

Volume 28 Number 01

Source: Capital Dynamics

Kuala Lumpur boasts of a fast expanding skyline. Look inside – you will find many of

them unoccupied. Not surprisingly, Tabung Haji recently slashed rentals of its offices.

In 2Q 2016, the headline inflation

rate moderated to 1.9% from 3.4%

in 1Q 2016.

Table 3 Manufacturing Output (y-o-y % change)

2Q 2015 1Q 2016 2Q 2016

Export-oriented industries

4.3

4.2

4.2

Electronics

-6.1

6.0

9.8

Electrical

37.7

6.4

7.8

Chemicals & chemical products

5.5

3.3

4.9

Petroleum products

0.9

1.2

5.0

Rubber products

7.6

6.9

4.7

Off-estate processing

7.3

2.7

-21.5

Domestic-oriented industries

3.5

4.6

2.8

Construction-related products

2.9

4.7

4.5

Fabricated metal products

2.8

5.4

5.9

Transport equipment

6.0

2.0

-7.4

Food, beverage & tobacco products

1.7

7.3

13.0

Overall

4.1

4.3

3.9

Source: Department of Statistics Malaysia, Bank Negara Malaysia

Demand Conditions

The year-on-year growth of

domestic demand jumped

to 6.3% in 2Q 2016 – see

table 4

. The year-on-

year growth of private and

public consumption further

improved to 6.3% and 6.8%,

respectively. Meanwhile,

investment registered a strong

expansion of 6.1% supported

by both private and public

investment.

Public Finance

In 2Q 2016, the federal

government deficit was

equivalent to 5% of GDP,

significantly higher than the

same period a year ago –

see

table 5

. Government

revenue declined due to

lower individual income tax

collections. Consequently, the

federal government debt rose

from 51% of GDP in 1Q 2015

to 53.4% of GDP in 2Q 2016.

Inflation

In 2Q 2016, the headline

inflation rate moderated to

1.9% from 3.4% in 1Q 2016.

This was mainly due to the

lapse of the GST impact,

which was implemented in Apr

last year.

Money Supply

The growth rate of broad

money supply, M3, picked up

to 1.9%, year-on-year, at the

end of Jun 2016 as a result of

continued credit expansion to

Table 4 Real Domestic Demand (y-o-y % change)

2Q 2015 1Q 2016 2Q 2016

Public consumption

6.9

3.8

6.5

Public investment

-8.1

-4.5

7.5

Private consumption

6.4

5.3

6.3

Private investment

3.9

2.2

5.6

Aggregate domestic demand

4.6

3.6

6.3

Source: Department of Statistics Malaysia, Bank Negara Malaysia

Table 5 Federal Government Finance (RM bln)

2Q 2015 1Q 2016 2Q 2016

Revenue

55.3

48.8

47.5

Operating expenditure

51.8

57.4

52.1

Current account

3.4

-8.6

-4.6

Net development expenditure

7.3

9.2

10.4

Overall balance

-3.8

-17.7

-15.0

Overall balance (% GDP)

-1.4

-6.1

-5.0

Source: Ministry of Finance Malaysia, Bank Negara Malaysia

Table 6 M3 Determinants (q-o-q change, RM bln)

2Q 2015 1Q 2016 2Q 2016

M3

-7.5

9.4

7.0

Net claims on government

-20.4

-0.9

-1.9

Claims on private sector

23.2

11.2

22.3

Net foreign assets

-3.5

-19.7

7.8

Other influences

-6.7

18.8

-21.2

Source: Bank Negara Malaysia

Table 7 Trade Balance (y-o-y % change)

2Q 2015 1Q 2016 2Q 2016

Gross exports

-3.7

1.0

1.4

Manufactured

2.3

6.4

4.8

Agriculture

-2.7

6.5

-2.9

Minerals

-36.0

-32.5

-24.4

Gross imports

-5.2

-0.4

3.1

Capital goods

-12.5

-12.9

10.2

Intermediate goods

-4.6

-3.1

-0.3

Consumption goods

25.4

24.6

9.9

Trade balance (RM bln)

20.4

23.9

17.9

Source: MATRADE, Department of Statistics Malaysia, Bank Negara Malaysia

the private sector – see

table

6

.

Interest Rates

The Overnight Policy Rate

was maintained at 3.25% in

2Q 2016, unchanged from

the preceding two quarters.

Meanwhile, the base lending

rate of commercial banks

edged up to 6.82%. The

1-month fixed deposit rate of

commercial banks remained

stable at 3.08%, while the

12-month fixed deposit rate

was lowered by 0.2 ppt to

3.29%.

External Trade

In 2Q 2016, exports

registered an improved

growth of 1.4%, mainly due

to a milder contraction in

the exports of minerals –

see

table 7

. Meanwhile,

imports rose by 3.1% in 2Q

2016 mainly due to a strong

expansion in capital goods

imports. Overall, the trade

surplus narrowed to RM17.9

bln in 2Q 2016.

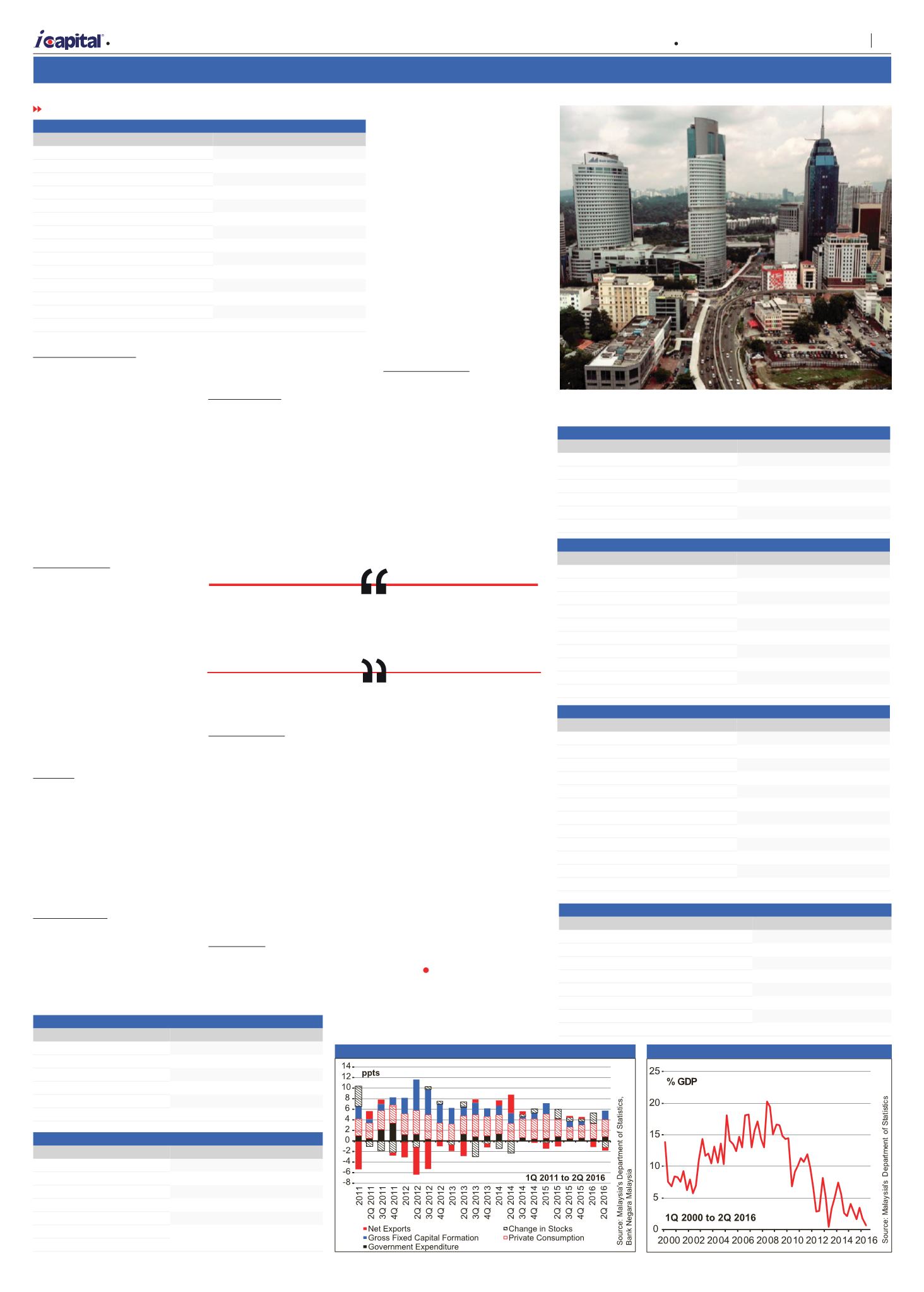

Comments

Private sector spending

remained the main growth

driver for the Malaysian

economy, with private

consumption alone

contributing 3.3 ppts to real

GDP growth in 2Q 2016 –

see

figure 1

. However, given

the weak global economic

conditions, Malaysia’s

economic growth could

weaken in the coming

quarters. This is reflected in

the falling leading index.

i

Capital forecasts Malaysia’s

real GDP growth for 3Q 2016

to be in the range of 3.0% -

4.5% but retains its forecast

for the whole of 2016 to be in

the range of 2.5% - 3.5%.

Regular updates

Balance of payments

In 2Q 2016, the current

account surplus more than

halved to RM1.88 bln. As

a percentage of GDP, the

current account surplus

also declined – see

figure

2

. The surplus in the goods

account fell, while the deficit

in the services account

narrowed too – see

table

8

. On the other hand, the

financial account recorded a

significantly larger net inflow

compared with the preceding

quarter as a result of higher

net inflows of direct and

other investments. Portfolio

investment experienced a

sharp decline in net inflow.

The overall balance of

payments registered a surplus

of RM8.77 bln.

The deficit in the services

account narrowed to

RM4.6 bln in 2Q 2016, led

by a smaller deficit in the

construction sector and larger

surpluses in the travel and

manufacturing sectors – see

table 9

.

Table 8 Balance of Payments (net in RM mln)

2Q 2015 1Q 2016 2Q 2016

Goods

23,648 23,490 19,808

Services

-4,983 -6,826 -4,634

Primary Income

-4,606 -6,688 -8,230

Secondary Income

-5,928 -4,937 -5,060

Current Account

8,131 5,039 1,884

Financial Account

5,741 5,789 9,496

Direct Investment

666 3,732 5,304

Portfolio Investment

-11,787 13,105

77

Other Investment

-449 -11,535 4,102

Errors & Omissions

-4,316 -38,388 -2,726

Overall Balance

8,450 -27,570 8,771

Source: Malaysia’s Department of Statistics

Table 9 Services Account Balance (net in RM mln)

2Q 2015 1Q 2016 2Q 2016

Transportation

-6,204 -5,567 -6,028

Travel

7,141 6,748 7,580

Manufacturing

1,986 2,008 2,214

Construction

-1,612 -2,297 -1,012

Insurance and pension

2,083 -1,974 -2,097

Charges for the use of intellectual property 1,170 -1,300 -1,139

Total

-4,983 -6,826 -4,634

Source: Malaysia’s Department of Statistics

FROM PAGE 2

Figure 2 Current Account Balance

Figure 1 Contribution to Real GDP Growth

A

| Market Opinion

3

Capital Dynamics Sdn Bhd