The week of 18 August – 24 August 2016

2

Intelligence

Independence

Integrity

Capital Dynamics Sdn Bhd

Volume 28 Number 01

Malaysia

A.1 Economic Fundamentals

Note fromPublisher :

This issue of

i

Capital marks another milestone for Capital Dynamics and

i

Capital.

With Volume 28, Number 1, we enter the 28th year of providing sound, objective,

and independent investment advice. We thank all subscribers and supporters for

staying with us throughout the years. Without any advertisement, each issue of

i

Capital is filled with solid original research and zero tips and rumours. This is

because it believes that in order to achieve superior return in the stockmarket, one

must do serious investing and to do that serious investment research is required.

At the same time,

i

Capital prides on itself as a publication that writes without fear

or favour, without hidden agenda. Capital Dynamics has no ties, past or present,

with any politicians, political entities, government organisations, investment

or commercial banks. As a consequence, Capital Dynamics is simply not placed

in a situation filled with conflicts of interest. In producing

i

Capital since 1989,

Capital Dynamics has never had to compromise its long-held core principles of

independence, intelligence and integrity.

i

Capital was born because Tan Teng

Boo recognised that Malaysians do not have access to sound, unbiased advice

or alternate views that are not pro or controlled, either openly or quietly, by any

political entities.

i

Capital has come this far because it believes in being a truth

seeker, no matter how painful it may be.

Being guided by its core value of independence, intelligence, and integrity,

i

Capital

will continue to be an investment advisor that serious investors and businessmen

can trust and rely on in the decades to come.

Low Guat Meng,

Executive Director

Date to be expected (Date in parentheses is actual release date).

Economic Calendar

Definitions:

Immediate-term :

next few weeks.

Short-term :

up to 7/8 months.

Medium-term :

up to 2/3 years.

Long-term :

beyond 3 years.

Source: Department of Statistics Malaysia,

Bank Negara Malaysia

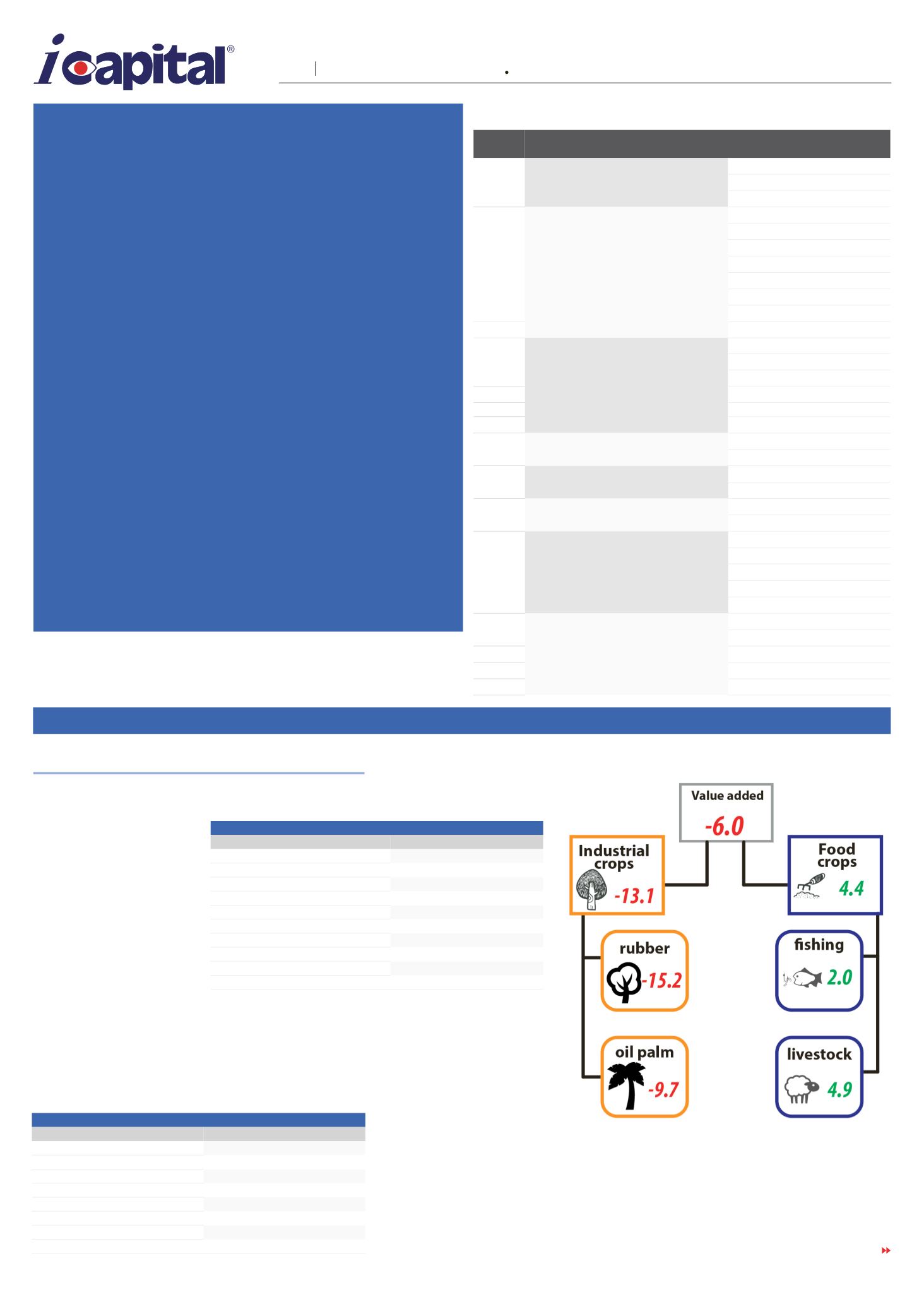

Value add in agriculture,(%)

22 Aug – 28 Aug

29 Aug – 04 Sep

Malaysia (24 Aug) Jul consumer price index

Jul producer price index

(25 Aug) Jun leading index

Jul money supply

Jul bank lending

US

(23 Aug) Jul new home sales

Jul personal income

(24 Aug) Jul existing home sales

Jul consumer spending

(25 Aug) 20 Aug initial claims

Aug consumer confidence index

(25 Aug) Jul durable goods orders

27 Aug initial claims

(26 Aug) 2Q GDP (2nd estimate)

Aug manufacturing PMI

Aug auto sales

Aug employment report

Jul trade balance

Japan (26 Aug) Jul consumer price index

Jul retail sales

Jul employment report

Jul household spending

Jul industrial production

Jul housing starts

Aug auto sales

China

Aug manufacturing PMI

Aug non-manufacturing PMI

Europe (26 Aug) Jul money supply, M3

Jul unemployment

Jul producer price index

Singapore

(23 Aug) Jul consumer price index

Jul trade price indices

(26 Aug) Jul industrial production

Hong

Kong

(22 Aug) Jul consumer price index

Jul retail sales

(25 Aug) Jul external trade

Jul money supply

Jul bank lending

Jul domestic home prices

Jul tourist arrivals

Australia

Jul private credit

Jul money supply

Aug index of commodity prices

Aug manufacturing PMI

Jul retail trade

Table 1 Performance of the Major Sectors (y-o-y % change)

2Q 2015 1Q 2016 2Q 2016

Agriculture

4.6

-3.8

-7.9

Mining & quarrying

6.0

0.3

2.6

Manufacturing

4.2

4.5

4.1

Construction

5.6

7.9

8.8

Services

5.0

5.1

5.7

Real GDP

4.9

4.2

4.0

Nominal GDP

4.1

4.9

5.4

Source: Department of Statistics Malaysia, Bank Negara Malaysia

Table 2 Value Add in the Services Sector (y-o-y % change)

2Q 2015 1Q 2016 2Q 2016

Finance & insurance

0.2

0.1

1.6

Real estate & business services

6.2

6.4

6.8

Transport & storage

5.4

5.8

5.9

Information & communication

9.3

8.5

8.8

Wholesale & retail trade

5.8

5.2

6.6

Food & beverages and accommodation

6.6

6.1

6.9

Utilities

3.9

6.7

5.4

Government services

4.0

5.3

4.9

Other services

4.7

4.6

4.4

Source: Department of Statistics Malaysia, Bank Negara Malaysia

Performance of the

Malaysian Economy in 2Q

2016

In 2Q 2016, Malaysia’s

real GDP rose by 4%,

year-on-year, a slower

growth rate compared with

the preceding quarter – see

table 1

. This was mainly due

to weaker performance of the

manufacturing and agriculture

sectors. Meanwhile, in

nominal terms, GDP growth

picked up to 5.4% in 2Q 2016.

Supported by stronger

household spending, the

services sector registered a

stronger growth rate of 5.7%

in 2Q 2016 – see

table 2

.

The slower growth in the

manufacturing sector was

primarily pulled down by

domestic-oriented industries

that grew a paltry 2.8%

compared with the same

quarter last year – see

table

3

. Apart from firm demand

for food, beverage & tobacco

products, domestic-oriented

industries generally recorded

weaker performance with

transport equipment industry

registering negative growth

rate. On the other hand,

growth in the export-oriented

industries was largely

supported by stronger

expansion in the electronics

and petroleum products

industries, which offset a

contraction in the off-estate

processing sector.

The stronger contraction

in the agriculture sector was

a result of lower palm oil

production arising from the

lagged effect of El Niño. The

mining sector expanded 2.6%

due to improvement in natural

gas output. Meanwhile,

growth in the construction

sector accelerated to 8.8%,

driven by stronger growth

in the civil engineering

sub-sector.

TURN TO PAGE 3

This section is based on a top-down/market-timing approach. In each issue of

i

Capital

®

, Capital Dynamics will look at the major

economic variables, locally and abroad, major equity markets plus some technical indicators before reaching its conclusion for the

KLSE Composite Index. In other words, Section A should be read in toto.

A

| Market Opinion