The week of 18 August– 24 August 2016

Volume 28 Number 01

Source: Capital Dynamics

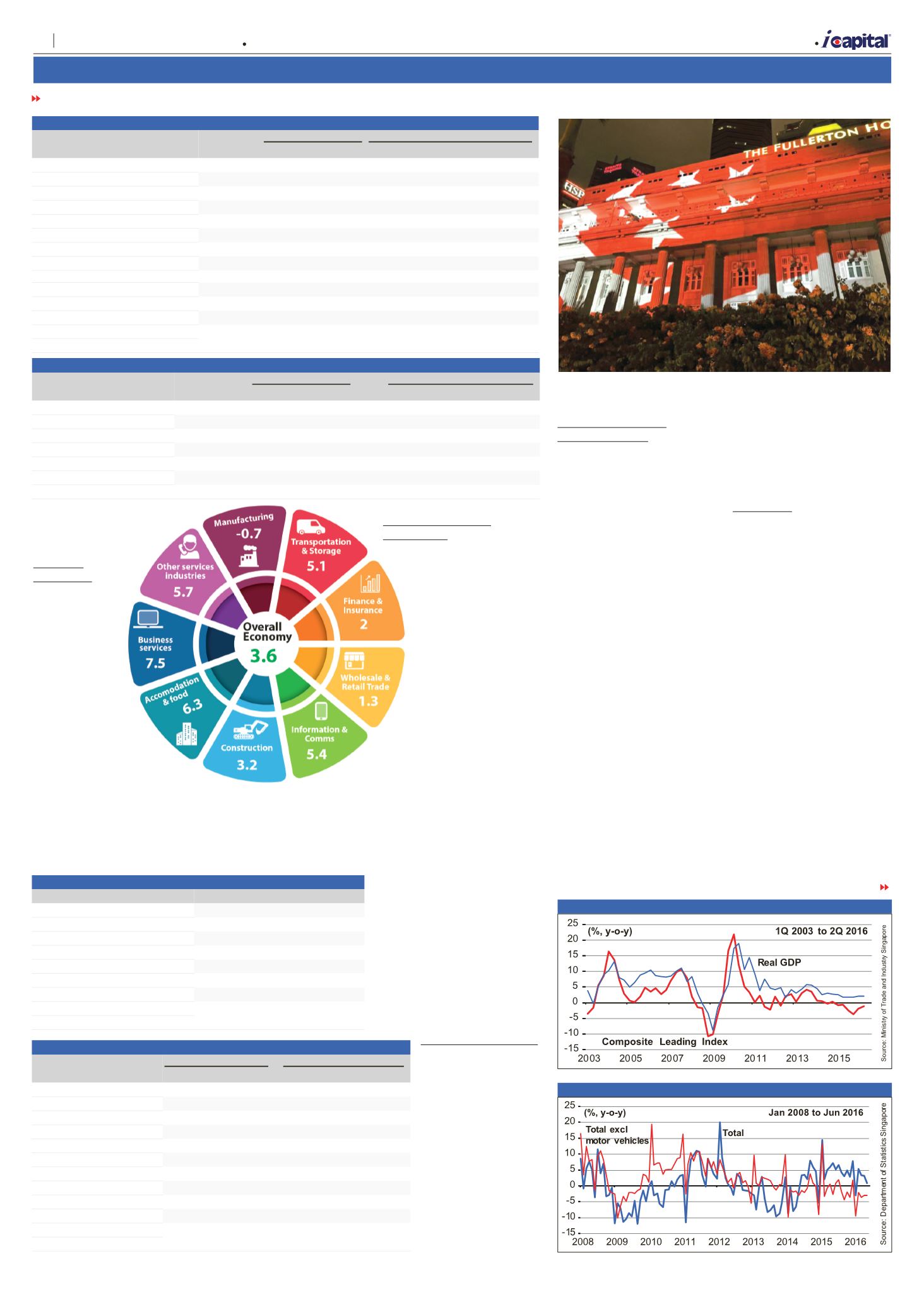

At only 0.3%, Singapore’s GDP growth crawled to almost a standstill in the 2nd quarter

and exports are still plunging.

Source: Ministry of Trade and Industry

Singapore

Change in unit labour cost in 2Q

2016 (y-o-y)

Table 16 Sectorial Performance (%)

Year-on-Year Growth Contribution to GDP Growth (ppts)

2Q 2015 1Q 2016 2Q 2016 2Q 2015 1Q 2016 2Q 2016

Goods-producing Industries

-3.2

0.6

1.6

-0.8

0.1

0.4

Manufacturing

-5.2

-0.5

1.1

-1

-0.1

0.2

Construction

3.6

4.0

3.3

0.2

0.2

0.2

Services-producing Industries

3.2

1.7

1.4

2.1

1.1

0.9

Wholesale & retail trade

5.5

2.9

2.2

1.0

0.5

0.4

Transport & storage

-1.0

-0.1

2.9

-0.1

0.0

0.2

Accommodation & food services

-1.1

1.7

1.6

0.0

0.0

0.0

Information & communications

5.8

3.1

1.2

0.2

0.1

0.0

Finance & insurance

6.6

2.7

0.8

0.8

0.3

0.1

Business services

0.6

0.1

-0.2

0.1

0.0

0.0

Other Service Industries

1.2

0.8

1.6

0.1

0.1

0.2

Overall GDP

1.7

2.1

2.1

Source: Ministry of Trade and Industry Singapore

Table 17 Demand Conditions (%)

Year-on-Year Growth

% Contribution to GDP Growth

2Q 2015 1Q 2016 2Q 2016 2Q 2015 1Q 2016 2Q 2016

Total Domestic Demand

1.8

9.6

-4.0

0.5

2.4

-1.1

-Consumption expenditure

3.8

5.3

4.8

0.6

0.9

0.8

-Investment spending

2.3

-2.8

1.1

0.2

-0.3

0.1

-Inventories

-0.9

4.7

-5.2

-0.3

1.8

-1.9

External Demand

0.4

-1.0

4.1

0.3

-0.7

3.0

Total Demand

0.8

1.7

1.9

Source: Ministry of Trade and Industry Singapore

wholesale & retail trade

sector.

Demand

Conditions

Year-on-

year, total

demand

gained 1.9%

in 2Q 2016,

driven by the

4.1% increase

in external

demand – see

table 17

. On the

other hand, total

domestic demand

contracted by 4.0% in

2Q 2016, in contrast to a

9.6% growth in the previous

quarter. Domestic demand

was pulled down by lower

inventory investment.

Labour Market and

Productivity

Total employment

rose by 5,500, quarter-

on-quarter, in 2Q

2016, slower than the

13,000 growth in the

preceding quarter.

The slowdown in

employment growth

was broad based.

Manufacturing

employment declined

for the seventh

consecutive quarter in 2Q

2016, falling by 3,400, as

a result of continued weak

performance in the transport

engineering clusters.

Meanwhile, construction

and services employment

rose by 8,600 and 400

respectively in 2Q 2016,

both slower than the growth

in the first quarter.

Year-on-year, total labour

productivity grew by 0.7% in

2Q 2016. The manufacturing

and wholesale & retail

trade industries reported

productivity growth of 4.6%

and 2.2% respectively.

However, productivity in the

business services sector

declined by 2.7%, year-on-

year.

Table 18 Balance of Payments (S$ mln)

2Q 2015 1Q 2016 2Q 2016

Goods balance

26,926.9 26,495 30,382.7

Exports of goods

130,730.9 115,739.1 125,310.8

Imports of goods

103,804 89,244.1 94,928.1

Balance of services

-2,363.5 -2,046.4

-2,748

Income balance

-7,784.3 -5,601.9 -6,782.5

Current account balance

16,779.1 18,846.7 20,852.2

Capital & financial account balance 13,322 26,898.3 15,781.9

Overall balance

2,686.5 -8,720.3 4,757.3

Source: Ministry of Trade and Industry Singapore

Table 19 Consumer Price Index

%change fromprior year %change fromprior quarter

2Q 2015 1Q 2016

2Q 2016

2Q 2016

Food

1.9

2.0

2.2

0.3

Clothing & Footwear

-0.6

2.1

0.6

-1.5

Housing & Utilities

-3.8

-4.1

-4.2

-2.3

HouseholdDurables &Services

-0.7

-0.8

2.3

1.4

Health Care

-0.3

0.7

0.9

0.7

Transport

0.1

-2.9

-5.2

0.5

Communication

1.0

-1.1

-0.5

0.0

Recreation & Culture

-0.1

0.4

1.2

0.6

Education

3.1

2.5

3.2

0.7

MiscellaneousGoods&Services

-0.3

0.5

0.4

0.1

Overall

-0.4

-0.8

-0.9

-0.2

Source: Department of Statistics Singapore

Price, Interest, and

Exchange Rates

Year-on-year, the CPI

fell by 0.9% in 2Q 2016.

As shown in

table 19

the

housing & utilities and

transport sectors were,

again, the main contributors

to the fall in the CPI. In

contrast, the costs of

food, household durables

& services, as well as

education continued to rise

in 2Q 2016. On a quarter-

on-quarter basis, the CPI

declined by 0.2%.

At the end of 2Q 2016,

the prime lending rate

stayed flat at 5.35%. In

terms of interest rates at

the 10 leading banks, the

12-month fixed deposit rate

and the savings deposit

rate remained unchanged

at 0.35% and 0.14%

respectively in 2Q 2016.

In 2Q 2016, the S$

appreciated 7.1% against

the Pound, 3.1% against

the Australian $, 2.9%

against the Chinese Yuan,

2.7% against the Malaysian

Ringgit, 2.1% against the

Euro, 0.2% against the US$

and 0.2% against the HK$.

On the other hand, the S$

depreciated 8.4% against

the Japanese Yen.

Comments

In 2Q 2016, the

Singapore economy

expanded by 2.1%, year-on-

year. Going forward,

economic conditions remain

challenging. Externally,

significant downside

risks could come from

the uncertainty arising

from Brexit as well as the

confusing monetary policy

in US. Domestically, growth

of external-oriented services

sectors could be adversely

affected by the softening

global economic conditions.

Reflecting these

developments, the

composite leading index

(CLI) declined by 1.1%,

year-on-year, in 2Q 2016 –

see

figure 11.

i

Capital revises its forecast

of Singapore’s real GDP

FROM PAGE 5

TURN TO PAGE 7

Balance of Payments

In 2Q 2016,

Singapore’s balance

of payments recorded

a surplus of 4.8 bln,

compared with an

8.7 bln deficit in the

previous quarter. This

reflected a larger

current account

surplus as well as a

smaller net outflow

in the capital and

financial account –

see

table 18

.

Figure 11 Real GDP Growth

Figure 12 Retail Sales

A

| Market Opinion

6

Capital Dynamics Sdn Bhd