The week of 18 August – 24 August 2016

Volume 28 Number 01

The 2nd Chance

Cash balance at 11 Aug 2016:

RM 60,613.57

Add: –

Less:

–

Net Cash Balance Available:

RM 60,613.57

Asset Allocation Percent (%)

Amount (RM)

Cash

100

60,613.57

Equities

-

-

Total

100

60,613.57

Comments:

Section D2

was set up, at our own initiative, to assist our subscribers who may have followed

our stock selections that have subsequently not worked out. The first part was started with

RM15,274.69 cash on 7 Dec 2000. The KLCI was 735.97 points. Subsequently,

The 2nd

Chance Portfolio

reached the original cost of RM80,000 and was closed.

On 30 Oct 2014,

i

Capital re-activated

Section D2

. It assumed that our subscribers initially

invested RM10,000 (or its percentage equivalent) for each dead duck and the quantity bought

was derived from there. Any dividends received have been ignored. We sold these dead ducks

on 30 Oct 2014 and would re-invest the proceeds at the right time. The objective is to recover

our principal as soon as it is realistically possible. Once this is achieved, we will close this

special portfolio again. So far, we have sold 16 counters at a cost of RM160,000.

Counter

Date bought

Qty

Price KLSE CI

Total cost Current price

+/-

Currently, no shares are in this portfolio.

Comments: The Second Chance

retains

its portfolio.

The objective of this

portfolio is capital recovery.

In terms of time, we hope

it would not take too long.

The investment approach

used by Capital Dynamics

will be a mixture of our

eclectic market timing

and trading. There are no

restrictions on the type of

shares or stock exchange

that will be invested in. Its

funds will come from the

sales of the dead ducks.

The 2nd part started with

RM57,591.50 cash on 30th

Oct 2014. The KLSE CI was

1,842.78 points. This paper

portfolio is supervised

by Capital Dynamics.

Purchases /sales are based

on daily closing prices.

Purchases/sales can be

made any day.

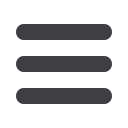

Portfolio Performance at 29 Jul 2016

The 2nd Chance

KLCI

Source: Capital Dynamics

-10.28%

2.82%

4.98%

-6.02%

cumulative return annualcompoundreturn

E.1. Updates on Section B (Stock Selections)

Announcements

BURSA MALAYSIA

AHEALTH

AMWAY

TMCLIFE

APM

UNIMECH

WASEONG

BPPLAS

TASCO

GENM

IVORY

PARAMON

Revenue for 6 months ended 30/06/2016 advanced 11.28% to

RM294.2 mln. Pretax profit grew 17.77% to RM24.68 mln. Net

profit rose 29.32% to RM19.46 mln. Net earnings per share were

16.61 sen. 5.5 sen dividend declared.

i

Capital retains its Buy below

RM3.00 rating.

Revenue for 6 months ended 30/06/2016 increased 12.71% to

RM574.8 mln. Pretax profit decreased 45.05% to RM34.81 mln. Net

profit declined 48.53% to RM24.23 mln. Net earnings per share were

14.74 sen. 5.0 sen dividend declared.

i

Capital retains its Sell rating.

It has entered into a memorandum of understanding with Advance

Renal Care (Asia) P/L to jointly explore establishing and/or operating a

dialysis centre in Thomson Iskandar Johor Bahru for one year.

Its indirect wholly owned subsidiary, APM Automotive IndoChina

Ltd (AAIL) has entered into a joint venture agreement with Tachi-S

(Thailand) Co Ltd (TACHI-S) to develop, manufacture, assemble and sell

automotive seats in Vietnam for the original equipment manufacturers.

The joint venture will also participate in the joint development of

automotive seats for customers requiring seat design development.

AAIL will contribute 49% of the investment capital while TACHI-S will

contribute the remaining 51%. The investment will be funded through

internally generated funds.

Its wholly owned subsidiary, Unimech Capital S/B has acquired a 49%

equity in Uni Media Studio S/B (UMS) from Mr. Chan Chee Keong

and Mr. Foong Chee Keong for a cash consideration of RM0.123 mln.

The business activity of UMS is the provision of media advertising and

related services. The acquisition is to strengthen its control of UMS and

benefit from the potential increase in earnings contribution from UMS in

the future. The acquisition was sourced from internally generated fund.

[i] With reference to the tender awarded by Nord Stream 2 AG to its

indirect wholly owned subsidiary, Wasco Coatings Europe B.V. for

the provision of concrete weight coating and storing of more than

200,000 pipes for Nord Stream 2 Project, a letter of intent was signed

to commence mobilisation of works pending the finalisation of a

formal contract to be signed. [ii] Its indirect wholly owned subsidiary,

Wasco Coatings Europe B.V. has acquired the entire stake in Dobona

Oy, a company incorporated in Finland for €2,500.00 (equivalent to

RM11,161.75). Dobona Oy is presently dormant.

Revenue for 3 months ended 30/06/2016 gained 9.13% to

RM129.7 mln. Pretax profit edged down 1.46% to RM8.148 mln.

Net profit inched down 1.28% to RM6.009 mln. Net earnings per

share were 3.0 sen. 2.50 sen dividend proposed.

i

Capital retains

its Hold rating.

Its indirect wholly owned dormant subsidiary, RWD US Holding

Inc. has filed for voluntary dissolution and it was dissolved.

With reference to Penang High Court Civil Suit No: 22NCVC-102-

06/2015, Ivory Indah S/B has succeeded in its application to strike

out the plaintiff’s writ and statement of claim and the court has struck

out the plaintiff’s case.

Revenue for 6 months ended 30/06/2016 slid 7.72% to RM258.6 mln.

Pretax profit edged down 4.91% to RM52.99 mln. Net profit dipped

9.79% to RM33.60 mln. Net earnings per share were 7.95 sen. 2.5 sen

dividend declared.

i

Capital retains its Hold rating.

Revenue for 6 months ended 30/06/2016 rose 22.47% to RM164.2

mln. Pretax profit increased 45.82% to RM14.37 mln. Net profit

expanded 40.18% to RM10.97 mln. Net earnings per share were

5.85 sen. 2 sen dividend proposed.

i

Capital retains its Buy below

RM0.89 rating.

TECNIC

Revenue for 6 months ended 30/06/2016 was zero. Pretax profit

plummeted 98.60% to RM2.615 mln. Net profit plunged 98.60% to

RM2.614 mln. Net earnings per share were 6.47 sen. No dividend

declared.

i

Capital retains its Hold rating

E

| Updates

D

| Medium Term Portfolios

27

Capital Dynamics Sdn Bhd