The week of 18 August – 24 August 2016

Volume 28 Number 01

TechnicalAnalysisof

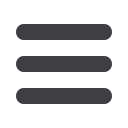

UMW Oil & Gas Corporation Berhad

UMW Oil & Gas

Corporation Bhd

(UMWOG) was listed

in 1 Nov 2013. The

IPO had an impressive

20 sen premium debut

with its institutional

books oversubscribed

by 55 times. Following

these, it surged 40% to

its 2014 peak. It then

moved sideways as it

awaits contributions from

acquisition of 3 jack-up

drilling rigs. Then oil

price plunged in 2014

FROM PAGE 22

from above US$110 per

barrel to below US$30.

Operating in a new

normal of low oil price,

any rebound would be an

excellent chance to sell

UMWOG.

UMW Holdings Bhd, had to

provide financial assistance

in Jun 2016 in the form of

an intercompany loan of

RM308 mln for working

capital purposes. The loan

repayment period is over 5

years.

Renewables

The world is also fast

facing the prospects of

a long-term transition

away from fossil fuels

towards renewable energy.

Renewable energy has

become more competitive as

its cost has plummeted and

technologies improved. In

emerging economies such

as Mexico, India, South

Africa and the UAE which

are driving the bulk of growth

in energy demand, wind

and solar power developers

are increasingly winning

contracts without subsidies.

For example, Germany’s

2 biggest power utilities,

RWE and Eon along with

Vattenfall and Norwegian oil

and gas group Statoil are

looking to drive down cost to

€80 per megawatt hour by

2025. Offshore wind farms

now cost an average of

€141/MWh which is already

around 15% lower than at

the start of this decade. They

are also taking advantage

of bigger turbines coming

on to the market. In the

The world is also fast facing the

prospects of a long-term transition

away from fossil fuels towards

renewable energy.

Renewable energy

has become more competitive

as its cost has plummeted and

technologies improved.

longer term, this potential

move away from fossil fuel

could hold down its price

indefinitely.

Conclusion

At RM0.98, UMW OG is

capitalised at RM2.119 bln.

For this, what do investors

get in return ?

For reasons mentioned

in

i

Capital dated 24 Mar

2016, oil price has continued

to remain low instead

of bouncing back to its

previous highs. The incident

of Brexit has also caused

the US$ to strengthen since

the currency is considered a

haven. In addition, amongst

the major developed

economies, only the US is

showing sustained growth. A

stronger US$ makes it more

expensive for oil purchases

in other currencies as oil

price is priced in US$.

The latest Bank for

International Settlements

annual report warned about

a risky trinity of conditions:

unusually low productivity

growth, historically high

global debt levels and

remarkably narrow room

for policy manoeuvre (think

Federal Reserve and Janet

Yellen). With the gloomy

macroeconomic skies

looming over the global

economy,

i

Capital retains

its Sell rating for UMW Oil &

Gas Corporation.

UMW Oil & Gas was

first featured in

i

Capital

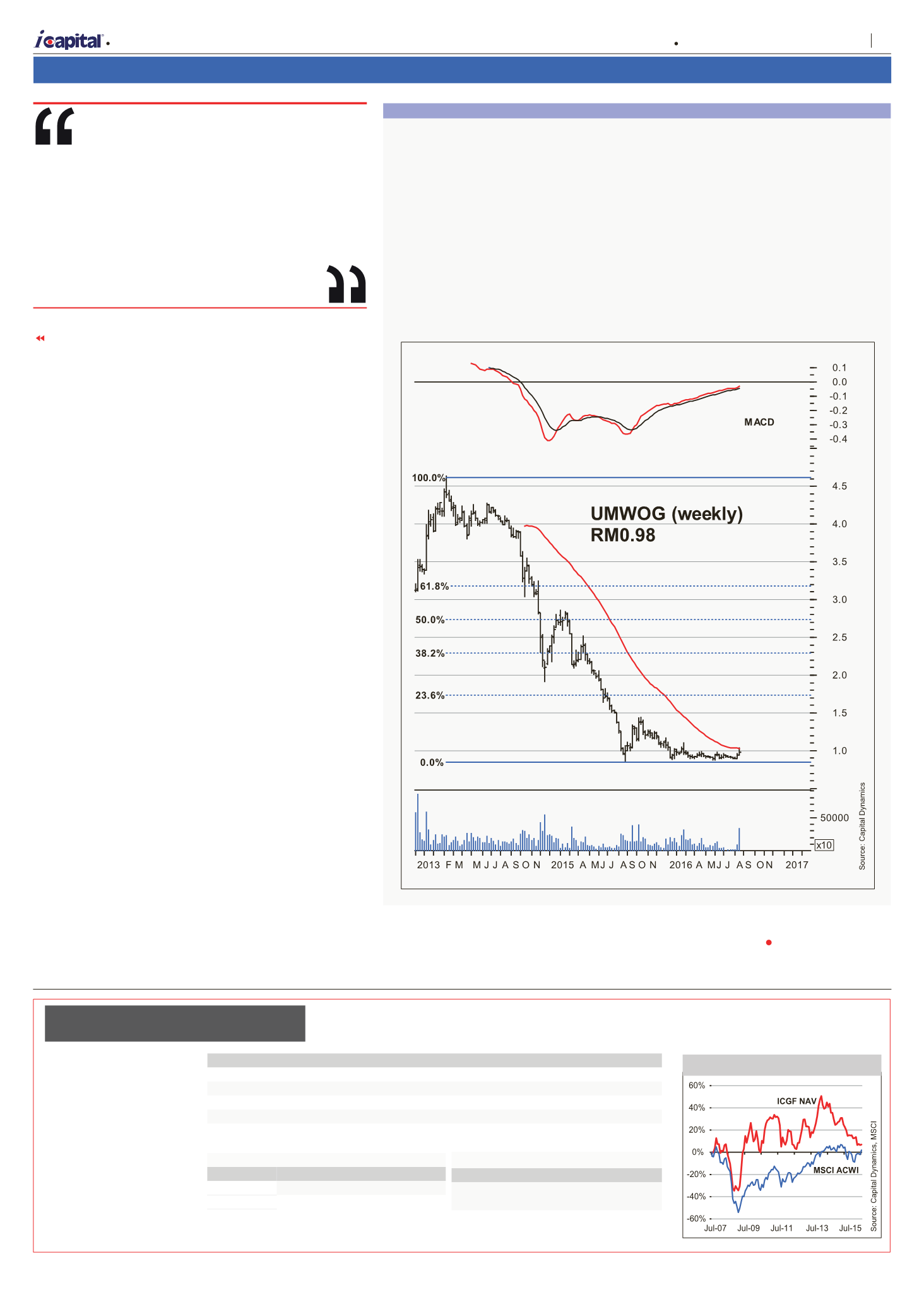

Recent Performance

30 Jun 2016 29 Jul 2016 % Change

ICGF NAV (US$)

1,064.691 1,070.547

0.55

MSCI ACWI (US$)

399.29

416.09

4.21

Total Return, From Inception

Since inception (%) Annual compound return (%)

7.05

0.75

1.99

0.22

NAV (as at 29 Jul 2016)

US$ 1,070.547

Fund Manager

Capital Dynamics (S) Pte Ltd

Structure

Open-end

Minimum Initial Investment

US$200,000

Features

No entry and exit fees, short selling, derivatives and no borrowings.

INCEPTION DATE – 6 JULY 2007

Introduction

C

apital Dynamics (S) Pte Ltd

(CDPL), the fund management

company, operates under the

purview of the Monetary Authority

of Singapore and is our platform

for global investing. CDPL is the

first Asian privately-owned global

fund manager. The objective is to

achieve superior long-term capital

appreciation by investing globally.

i

Capital Global Fund

ICGF CUMULATIVE PERFORMANCE IN US$

(JUL 2007 TO JUL 2016)

The performance of

i

Capital Global Fund for the period 6 July 2007 to 31 Dec 2015 has been independently verified. The performance for the period 1 January 2016 to 29 Jul 2016 is believed to be

reliable, but has not been independently verified. Past performance and any forecast are not necessarily indicative of future or likely performance.

dated 4th Dec 2014 at price

of RM2.56. Subscribers

who followed its lonely Sell

advice then would have

saved RM1.58 or a hefty

loss of 62%. With this latest

write-up,

i

Capital will stop

monitoring UMW Oil & Gas

until it is appropriate to do so

again.

B

| Stock Selections

23

Capital Dynamics Sdn Bhd