The week of 18 August – 24 August 2016

Volume 28 Number 01

FROM PAGE 24

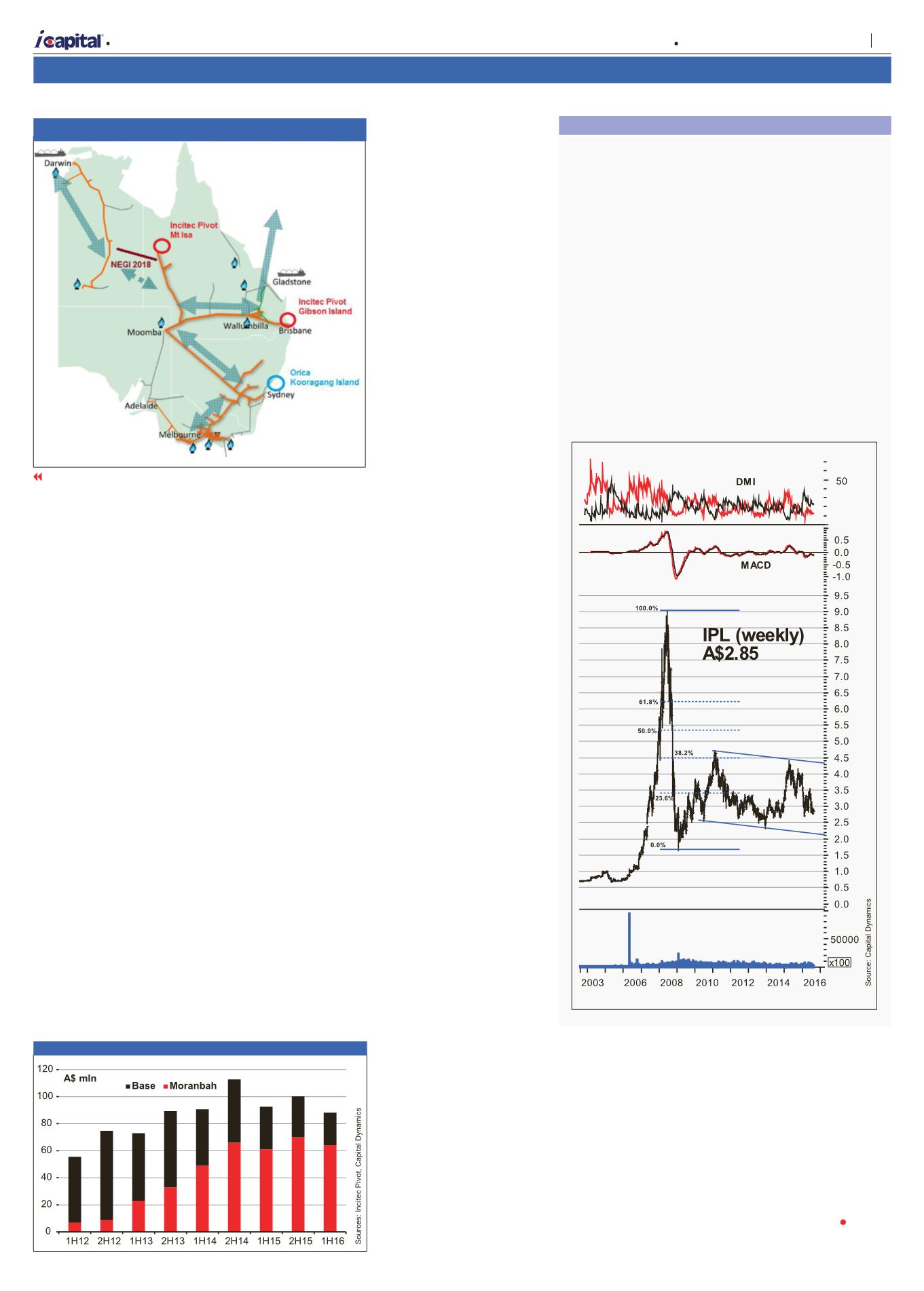

Technical Analysis

Of Incitec Pivot Limited

Listed on the ASX in Jul

2003, Incitec Pivot Limited

(IPL) traded sideways for

3 years. Then, with the

acquisition of Southern

Cross Fertilisers (SCF) in

2006, it rocketed to a high

of A$9.00, an impressive

800% growth as a result

of the continuing success

of their cost savings

programme, the integration

of SCF and the subsequent

acquisition of Dyno Nobel.

Unfortunately, the 2008

US-led global financial crisis

sent it plunging in a vertical

manner to retrace almost its

entire surge. The recovery

was slow for IPL and

hovered around the lower

boundary for 2.5 years.

Its weekly MACD has now

shaped a bearish crossover.

With its new Louisiana plant

due to commence soon, IPL

may find support from its

lower boundary.

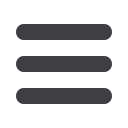

Figure 2 Large Chemical Plants on Austraila’s East Coast Gas

Transmission Network

Figure 3 Incitec Pivot Dyno Nobel Asia Pacific EBIT Breakdown

natural gas, is less exposed

due to two reasons. First, it

produces DAP/MAP which

also relies on a cheap source

of phosphates and sulfuric

acid – Mt Isa is a vertically-

integrated operation with

phosphates sourced on-site.

Secondly, it has entered into

a contract with the Northern

Territory (NT) government

as an off-taker from 2018

following the completion of a

new gas pipeline connecting

the NT gas resource to

Mt Isa, driving gas prices

down to around A$5.00/GJ

from the current A$9.50/GJ

interim agreement. Given

the poor outlook, IPL took a

A$154.5 mln impairment on

GI assets during 1HFY16

Although IPL is encouraging

a grass roots campaign led

by the farmers near GI to

pressure the government

into finding a solution, the

fact of the matter is that the

internationalisation of natural

gas on Australia’s east coast

has completely changed the

landscape.

i

Capital believes

that GI will be shut down

not long after its gas expiry

in 2018 and subsequently

transition into a pure

wholesaler and distributor

of urea. This transition

should not materially affect

operations, given it already

imports half of its annual

urea requirements. Low

commodity prices, along

with fall in volumes, meant

that fertiliser earnings before

interest and taxes (EBIT) fell

7.8% to A$54.4 mln 1HFY16

with margins holding steady

at 10.3%.

Explosives Business

Within its Australian

business, Moranbah remains

the main contributor to

EBIT as Base earnings

have halved since 2012,

indicating the extent of the

pain being felt across the

mining sector, in turn being

inflicted on product and

services providers – see

figure 3.

Underpinning

this performance is stable

production volumes at

Moranbah despite gas

curtailments by its supplier

Shell/PetroChina during

1HFY16. Persistently low

natural gas prices and

the mild winter in North

America saw Ammonium

Nitrite volumes supplied

to the coal sector declined

~26% against 1HFY15, as

energy businesses stockpiled

their coal inventories and

postponed further blasting.

Coal represents around

half of IPL’s North American

exposure. The plunge in the

iron ore price also meant that

volumes in the metals and

mining segment, representing

a third of total North

American volumes declined

by ~30%. The bright spot for

IPL during 1HFY16 is the

continued growth in quarry

and construction (Q&C) of

~18%, representing 25% of

total volume sales.

IPL’s North American

quarry and construction

segment is expected to

benefit further from the

five-year US$305 bln

highway bill signed by

President Obama in Dec

2015 (US$205 bln for

highways and US$48

bln for transit projects).

Therefore the only existing

bright spot for IPL’s North

America operations is the

Q&C segment. It is unlikely

that its coal or metals and

mining business will turn

around in the near future,

given both structural changes

and supply and demand

fundamentals. What will truly

shift the needle for IPL is

its Louisiana project, which

is due to come on-stream

during the 2nd calendar half

of 2016. The management

intends to take its time in

ensuring the US$850 mln

ammonia plant is ready

to commence its 50 plus

year production run. It is

currently 97% complete,

having recently completed

the commissioning of the

reformer. Capital spent as

of May 2016 is US$712

mln. With Louisiana’s entire

800,000 tonnes output

contracted on take-or-pay

terms, at Jun 2016 prices

of ~US$315 per tonne

for ammonia (Tampa)

Louisiana’s earnings alone

would be comparable to

that of IPL’s whole fertiliser

business.

Conclusion

At A$2.85, IPL is

capitalised at A$4.81 bln. For

this, what do investors get in

return ?

It is ironic that IPL, which

was once but an arm of the

Orica conglomerate will

soon, with the completion of

its Louisiana plant, surpass

its former parents’ annual

earnings. Its Moranbah plant

has served the business

well throughout the mining

downturn, with the take or

pay earnings providing a

buffer to margin pressures

from its metallurgical

coal customers. Despite

persistently poor conditions

in North America’s coal

sector, IPL’s geographic

focus on the still competitive

Powder River Basin along

with a resurgence in Q&C

means that its earnings

should hold fairly steady.

Most importantly, as

Louisiana approaches

commissioning in late 2016

and with output contracted

out on terms similar to

Moranbah, IPL’s cash flows

are expected to materially

change from FY17 onwards.

This is timely for the

business, given GI is unlikely

to continue to operate from

early 2018 following the

expiry of its gas contracts.

With fundamentals still intact,

a robust balance sheet and

a substantial step-change in

earnings in the near future,

i

Capital maintains its Buy

below A$1.93 rating.

B

| Stock Selections

25

Capital Dynamics Sdn Bhd