to the private sector because

their professional rankings

can only be enhanced by

their performance in public

hospitals. Any doctor who

wants career advancement

would rather stay with a Class

3 (containing at least 500 beds)

public hospital. They prefer

the security and prestige of

state hospitals. In addition,

despite the Western media

reporting patient dissatisfaction

with public hospitals, private

hospitals have low social

recognition and, hence, only a

limited number of outpatients.

In general, the people believe

that doctors who are not

practicing in large public

hospitals are less qualified

than those who are. This is

evidenced by the following fact:

while almost half of China’s

hospitals are private, around

90% of total medical care is

provided by public hospitals.

IHH’s initial strategy

to enter parts of China is

to introduce its Parkway

Health brand under its own

small medical centres. Only

when the brand becomes

established among the locals

will IHH move into operating a

hospital. The group will form

an alliance with a local partner

and target only rich paying

customers; for example,

expats with offshore insurance

capable of paying high prices.

In addition to recruiting from

abroad, the group will try to

arrange with local universities

to supply them with specialists

(the same arrangement exists

between Gleneagles Hong

Kong and the University of

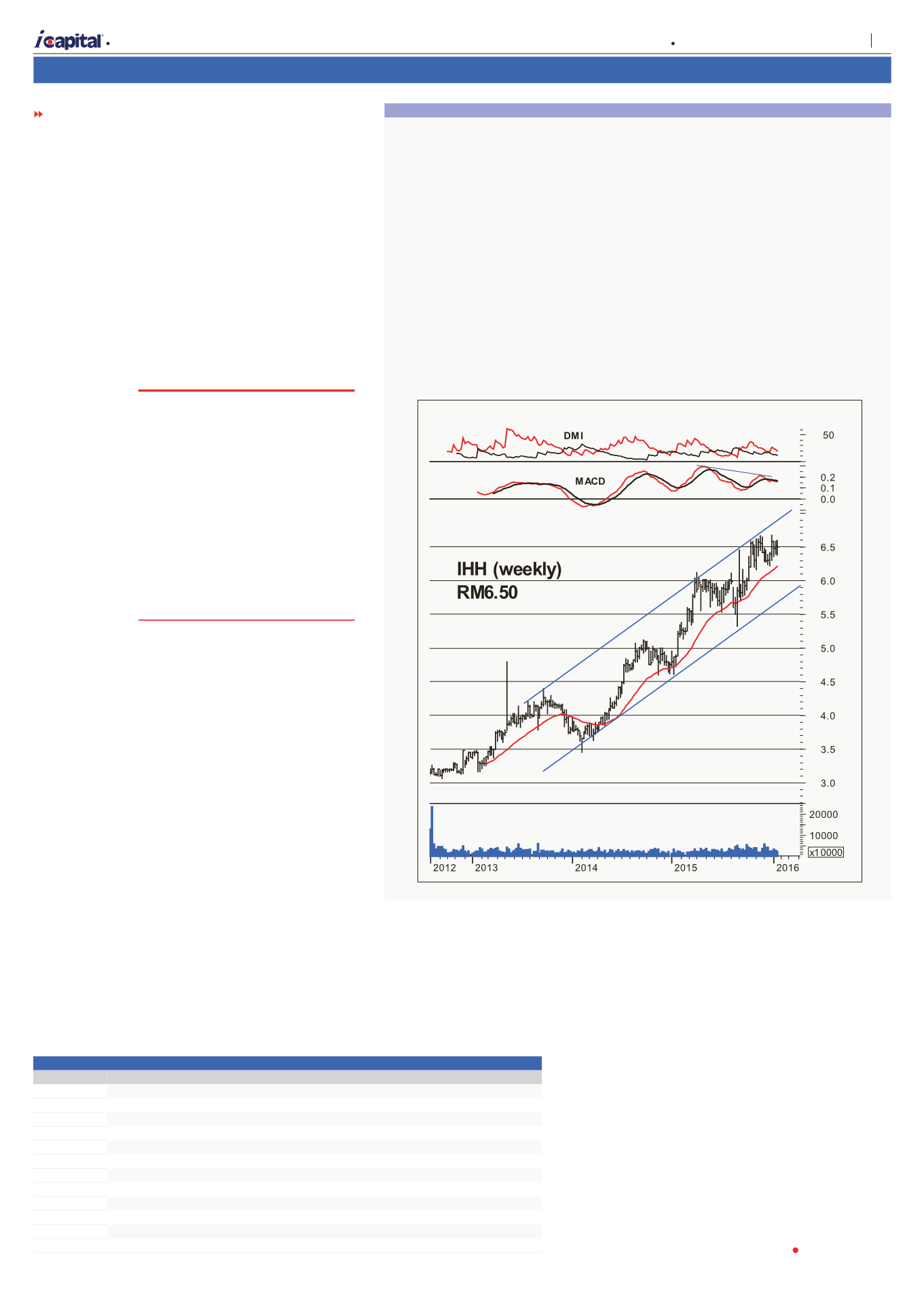

Technical Analysis

of IHH Healthcare Berhad

IHH Healthcare (IHH) broke out

from the sideways trend in 2013

and ascended in a gradual manner.

Upon hitting its resistance line, it was

shoved back and the support at around

RM3.50 halted it from falling further.

This provided IHH with sufficient

momentum for it to rally higher. As

the group continued to record higher

revenue, the support line held extremely

well and it constantly surpassed its

previous peak on each rebound to

create new highs, thus forming an

upward sloping price channel. Now,

it has once again reached the upper

boundary of its channel but the strong

resistance seems to be causing it to

lose its upward momentum, and its

weekly directional movement index is

turning bearish. With its weekly MACD

diverging bearishly for the 1st time, IHH

is expected to find its first support at the

lower boundary of its channel. Should

this break, IH would be in a new bear

trend.

FROM PAGE 12

patients can use money from

their Medisave accounts for

day surgery or in-hospital

admissions; however, they

have to be referred by the

group’s Singapore centres first.

This could help the hospital

reduce its turnaround period.

China

In China, IHH, along with

its Chinese partner, Shanghai

Broad Ocean Investments Co.

Ltd, formed a subsidiary in Oct

2015 in which the group will

own a 60% stake. This was

done so that the

group could lease

and operate a

350-bed hospital

in Chengdu

from Perennial

Real Estate

Holdings Limited.

The capital

expenditure from

the subsidiary,

which will be

disclosed at a

later date, will

comprise medical

equipment.

The hospital

is expected

to open in 2H

2017. Chengdu is the fastest

growing city in Western China.

As China shifts its

growth paradigm from a

debt-fuelled investment-driven

(manufacturing,

construction, etc) strategy

to a more consumption-

and services-oriented one,

healthcare services is one

industry that is set to reap

benefits. The government

has been signalling a

positive attitude towards

developing private hospitals.

To accelerate development, it

has taken measures including

exemption from business tax,

the promotion of free flow of

human talent among different

medical agencies and the

encouragement of diversified

funding sources.

However, investors often

see the business opportunity in

hospitals without understanding

how challenging it is to run

one well in China. Many

doctors are reluctant to shift

“The group, which

already has a strong

foothold in Malaysia,

Singapore and Turkey,

is going after the big

emerging markets,

namely China and

India.”

Hong Kong). However, as

mentioned above, attracting

doctors from public hospitals

will be a challenge, especially

when taking into account the

fact that doctors will have to

seek permission from their

respective public hospitals

during a time when public

Source: Capital Dynamics

hospitals are short-staffed.

Management structure

Each individual hospital

will be run by its own CEO,

who will report to the Country

CEO and subsequently

report to the group’s CEO,

Dr Tan See Leng. Part of

the process of selecting a

CEO is putting candidates

through the Parkway Pantai

philosophy and system for

several years. Only after that

period has passed will they be

assigned to apply the group’s

philosophy according to local

conditions.

Conclusion

At RM6.50, IHH is

capitalised at RM53.4 bln. For

this, what do investors get in

return ?

IHH’s Singapore operation

acts as a cash cow to fund

overseas expansions. Its

net gearing position is

currently 18%. Its banks

are comfortable with a net

debt over earnings before

interest, tax, depreciation and

amortisation ratio of 3.5. As

at 3Q 2015, the ratio stood

at 1.90. The group, which

already has a strong foothold

in Malaysia, Singapore

and Turkey, is going after

the big emerging markets,

namely China and India. The

potential and possibilities

are vast, but so are the

challenges. IHH’s current

valuation is rich.

i

Capital

retains its Sell rating for IHH

Healthcare.

Table 1 Expansion

Type

Hospital

Description

Target completion Cost

Expansion Gleneagles KL

100 beds

Completed

RM28 mln

Expansion Pantai Hospital Ayer Keroh

160 beds

Early 2017

RM138.8 mln

Expansion Pantai Hospital Klang

80 beds

Planning stage

RM49 mln

Expansion Pantai Hospital KL

Phase 2: 120 beds Planning & Design RM70.8 mln

Greenfield Gleneagles Medini, Johor

Phase 1b: 160 suites 3Q 2017

N/A

60:40 JV Gleneagles Hong Kong

500 beds

Early 2017

RM1.8 bln

50:50 JV Gleneagles Khubchandani, Mumbai 450 beds

2017

N/A

Expansion Acibadem Maslak, Turkey

200 beds

2017

RM246.4 mln

Greenfield Acibadem Altunizade, Turkey

325 beds

1Q 2017

RM448.5 mln

Greenfield Acibadem Kartal, Turkey

120 beds

early 2017

RM291.7 mln

Greenfield Acibadem Atasehir, Turkey

180 beds

Under evaluation RM256.9 mln

Source: Company data

B

| Stock Selections

13

Capital Dynamics Sdn Bhd

The week of 21 January – 27 January 2016

Volume 27 Number 21