This week, we are not talking

about forecasts. This issue

of

i

Capital is talking about

facts; facts that have not been

highlighted or reported or

analysed in the media. From a

risk management standpoint,

it is important to get all the

facts. The above figures are

telling us that something is

wrong with the US economy.

This development is very

worrisome as investors and

regulators and governments

are not prepared for such a

negative outcome. As

i

Capital

thought aloud last week, a

plunge in the Dow Jones

Industrial Average to 6,000

would have catastrophic

consequences. It would

make the collapse of Lehman

Brothers in Sep 2008 look like

a Sunday picnic. The stock

market plunging now is only

the beginning of 2015-2017

Chapter Two of the US-led

global financial crisis. The

economic impact will follow

suit in the coming months. For

the economy, 2016 and 2017

will be terrible. Remember,

i

Capital is forecasting

a L-shaped economic

environment. How long will the

horizontal line be ? How many

years ?

i

Capital retains its

outlook of the KLSE at a

range of 1,500 to 1,700 for

the

immediate-term

. See

Stop Press for the latest.

For the

short-term

,

i

Capital

retains its bearish outlook at

a range of 1,400 to 1,700.

The

medium-term

outlook

of

i

Capital is retained with

a possible bearish target

range of 800-900.

i

Capital

still expects the KLCI to drop

below 1,000 points for its

long-term

outlook.

and the bearish Shanghai

stock market, we already

have many other indicators

telling us that the bad times

are already here; namely,

Russell 2000, NASDAQ,

Transportation, SOX, Apple

and more. The markets

plunging are not due to the

slower economic growth

seen in China. This is pretty

old news. Oh ya, we forgot

to mention that Italian bank

shares have also crashed.

Unicredit, Italy’s largest bank

by market capitalisation,

has crashed 42% since its

mid-2015 high –

figure 11

.

And Unicredit is not the only

Italian banking stock to crash.

Are we then going to have a

new Eurozone crisis soon ?

The KLSE

Last week,

i

Capital and

Tan Teng Boo shared many of

its uniquely bearish forecasts.

“As

i

Capital has previously

advised, falling oil price should be

a boon for the transport stocks.

Yet, the Dow Jones Transportation

Average has been plunging since

the end of 2014. From the end

of 2014 to now, the Dow Jones

Transportation Average has

already plunged 30%”

“Last week,

i

Capital and Tan Teng

Boo shared many of its uniquely

bearish forecasts. This week, we

are not talking about forecasts.

This issue of

i

Capital is talking

about facts; facts that have not

been highlighted or reported or

analysed in the media. From a

risk management standpoint, it is

important to get all the facts. The

above figures are telling us that

something is wrong with the US

economy.”

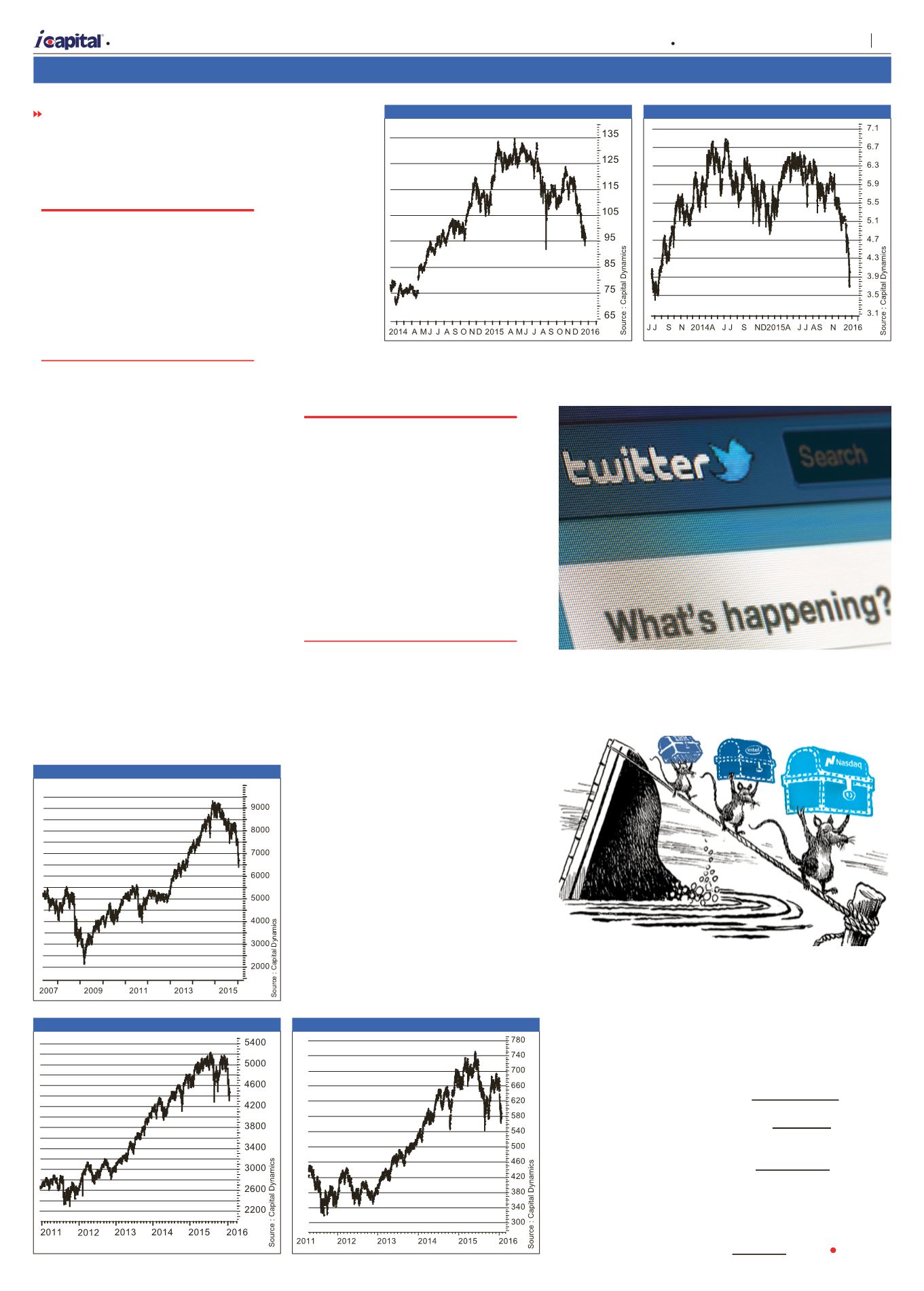

in a bear market ?

As

i

Capital has previously

advised, falling oil price

should be a boon for the

transport stocks. Yet, the Dow

Jones Transportation Average

has been plunging since the

end of 2014. From the end of

2014 to now, the Dow Jones

Transportation Average has

already plunged 30% -

figure

7

. If this is not a bear market,

then, we do not know what

is. Yet, you do not read this

bearish development in the

Western media headlines or

the analyst reports. A bearish

Dow Jones Transportation

Average has very negative

messages for the global

economy. This index peaked

in end-2014/early 2015. This

means that the deterioration

at the global economy level

will be seen in 2016. Fasten

your safety belt. And get a

super strong one. So far, the

Dow Jones Transportation

Average has plunged almost

the same number of points as

it did in 2008-2009.

The bear market is not

confined only to the Russell

2000 or the transportation

stocks. Even the technology

rich NASDAQ has been

faltering – see

figure 8

.

The technology sectors are

supposed to be innovative,

full of new products

and disruptive

technologies. So

far, the plunge is a

bit short of a 20%

bear market but

other technology

indicators have

already gone to

bear territory. The

message is that the

NASDAQ still has

a long way to fall. It is not just

“old” technology stocks like

Intel or IBM; the

falls are across

the board.

Even Twitter

is struggling to

survive.

Figure 9

below shows

the SOX or the

Philadelphia

semiconductor

index. Like the

other indices

shown above,

it is already

trapped by

the bears. No

wonder, this

fact has been unreported or

not highlighted.

Figure 10

is

even more interesting. Apple

Inc, the company that many

touted to be the 1st trillion

dollar company has also

been snared by the hungry

bears. It is no

fun reporting

rotten apple.

Even suppliers

to Apple

like Analog

Devices have

plunged.

So, the

truth of the

matter is that

besides the

plunging oil

price, the

supposed

crash of

China’s

economy,

Source:

www.shutterstock.comSource:

drugmonkey.scientopia.orgFROM PAGE 10

Figure 7 DJ Transportation Average

Figure 8 NASDAQ

Figure 9 SOX

Figure 10 Apple Inc

Figure 11 UniCredit S.p.A.

A

| Market Opinion

11

Capital Dynamics Sdn Bhd

The week of 21 January – 27 January 2016

Volume 27 Number 21