“The Chinese move to a basket

is understandable because

the dollar is strengthening,

but the yen and the euro are

weakening, so clearly some of

the actions that have been taken

to weaken currencies do have

effects elsewhere” and China’s

currency move cannot and

should not be seen in isolation

from what is happening

elsewhere. To do so would be

distorting the real intentions

behind China’s move.”

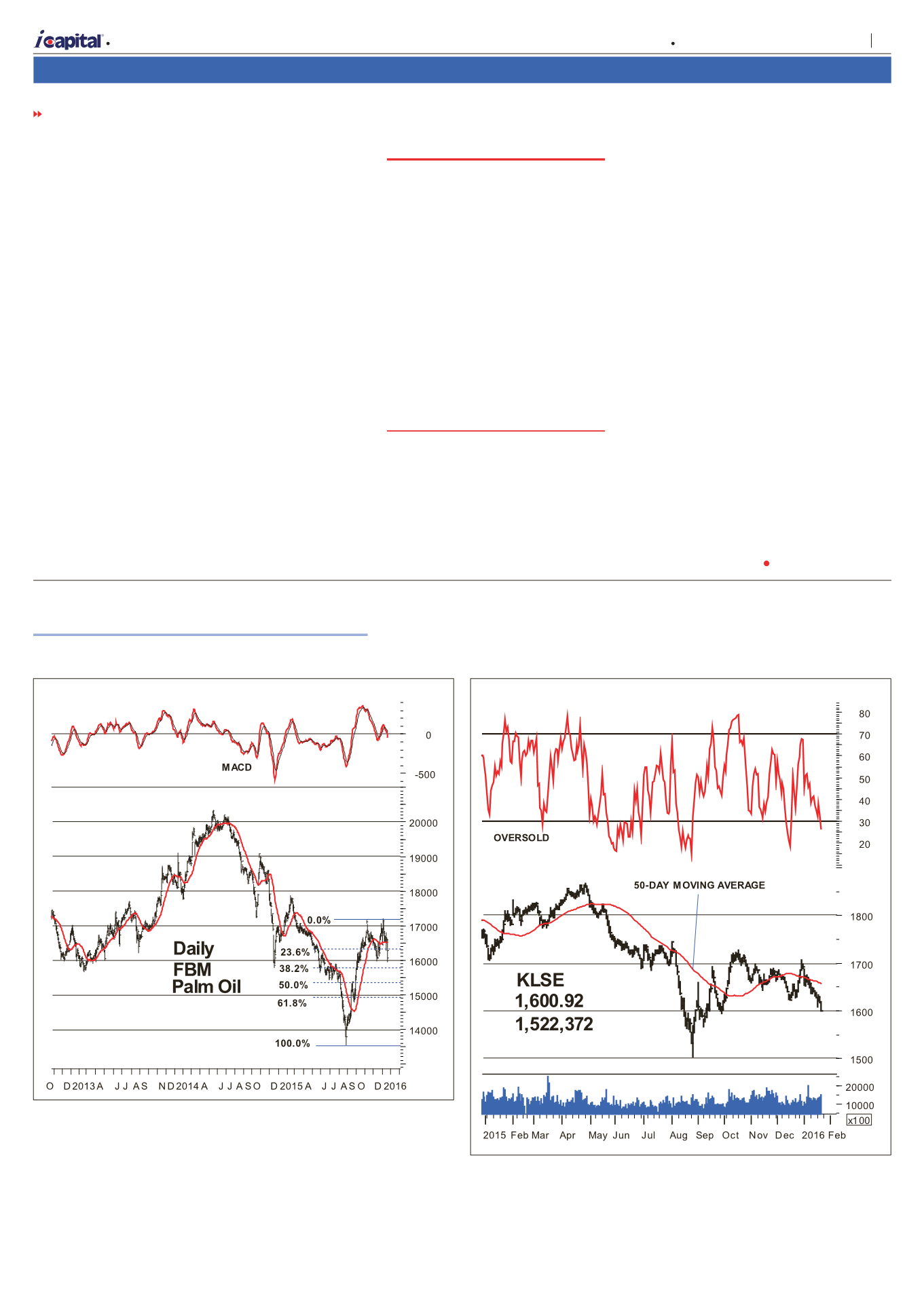

A.3. KLSE Technical Analysis

One technical indicator is shown per issue.

The KLSE CI is below its 30-day, 50-day and 50-week moving averages. Both its

daily DMI and MACD are bearish. The KLCI is again testing the 1,600 level. With

the global markets expected to rebound from highly oversold positions, the KLCI

may have a bit more time before falling again.

This week’s

i

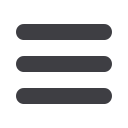

Capital updates the daily FBM Palm Oil Index. In 2013, the index

was rallying, and peaked out at 20,331 point in May 2014. Since then, it has been

trapped in a downtrend. Its first attempt to stage a rebound failed; the second

attempt was also not successful as the index stayed beneath its 30-day exponential

moving average. It found its support in Aug 2015 and rebounded. Despite the El

Nino season, palm oil prices have not risen strongly. The index is currently facing

major resistance. Even when palm oil inventories slumped to a 10-month low in

Dec, the index failed to penetrate its resistance and fell below its moving average.

With its daily MACD has shaping a bearish crossover, the index is expected to

retest 13,500 points.

STOP PRESS:

Source: Capital Dynamics

Source: Capital Dynamics

in debt level is a cause for

concern. In fact, the Chinese

government has been

taking steps to address the

problem. China’s Budget

Law has been amended to

allow local governments to

issue bonds on their own. In

addition, the State Council

issued the first comprehensive

guideline on how to deal

with local government debt

in a systematic manner in

Sep 2014. The guideline set

down strict conditions for how

debt may be raised by local

governments and how the

proceeds may be used. In

addition, two debt swap plans

have been arranged to bring

down the interest payment

burden and improve the

duration structure of debts.

The third debt swap plan is

in the pipeline. In order to

reduce the responsibility of

local governments in carrying

out infrastructure investment,

a public private partnership

programme was also

introduced in 2013; at the end

FROM PAGE 8

of 2015, 6,650 projects worth

RMB8.7 trillion were approved.

Three, China has

acknowledged that excess

capacity in the heavy industry

and housing sector is a drag

on her economy. In fact, one of

the key policy focuses in 2016

is encouraging restructuring,

liquidation, mergers and

acquisition, as well as allowing

market forces to weed out

failed companies. Given time,

the excess capacity should

be eliminated. In addition,

domestic demand in China is

unlike that of Japan’s in that

it is strong and big enough to

prevent a contraction in prices.

Even during the present bust

in commodity prices, China

has not fallen into deflation.

Four, China is in a

transition phase of allowing

market forces to play a

determining role in resource

allocation and price setting.

She is also in the transition

period of phasing out the

labour-intensive, low value

add industries and replacing

them with industries on the

higher end of the value chain.

Obviously, the transformation

is massive, complex and

requires suffcient time to be

implemented successfully.

President Xi Jinping and his

team are certainly committed

to reforming and getting rid of

excesses that have built up in

the economy over the years.

Given time, the reforms should

yield the desired results.

China’s government is not only

reforming the economy, it is

even reforming the People’s

Liberation Army.

The current

turbulence in

the stock and

currency markets

is a small hiccup

in China’s

long-term reform

agenda. As

i

Capital advised

elsewhere

in this issue,

for one thing,

the economic

slowdown in

China has been

going on for

years. It is the

most telegraphed,

the most intended,

and the most

well planned

economic slowdown in the

history of mankind. What is

surprising is that the stable

economic growth in China in

the last few years has instead

been interpreted and reported

in the media and analyst

reports as China’s economy

crashing and heading for a

major crisis. In this context,

it pays to listen to Raghuram

Rajan, India’s respected

central bank governor. He

advised that China is still

contributing to global growth

as it adjusts its currency policy

and shifts to consumer-led

growth. What Rajan says

about China’s currency is

valuable and fair but this has

been cruelly ignored by the

Western media. Rajan advised

that the Chinese authorities

should be taken at their word

when they say they are not

deliberately depreciating the

currency. He explained, “The

Chinese move to a basket

is understandable because

the dollar is strengthening,

but the yen and the euro are

weakening, so clearly some

of the actions that have been

taken to weaken currencies

do have effects elsewhere”

and China’s currency move

cannot and should not be

seen in isolation from what

is happening elsewhere. To

do so would be distorting the

real intentions behind China’s

move.

A

| Market Opinion

9

Capital Dynamics Sdn Bhd

The week of 21 January – 27 January 2016

Volume 27 Number 21