Australia

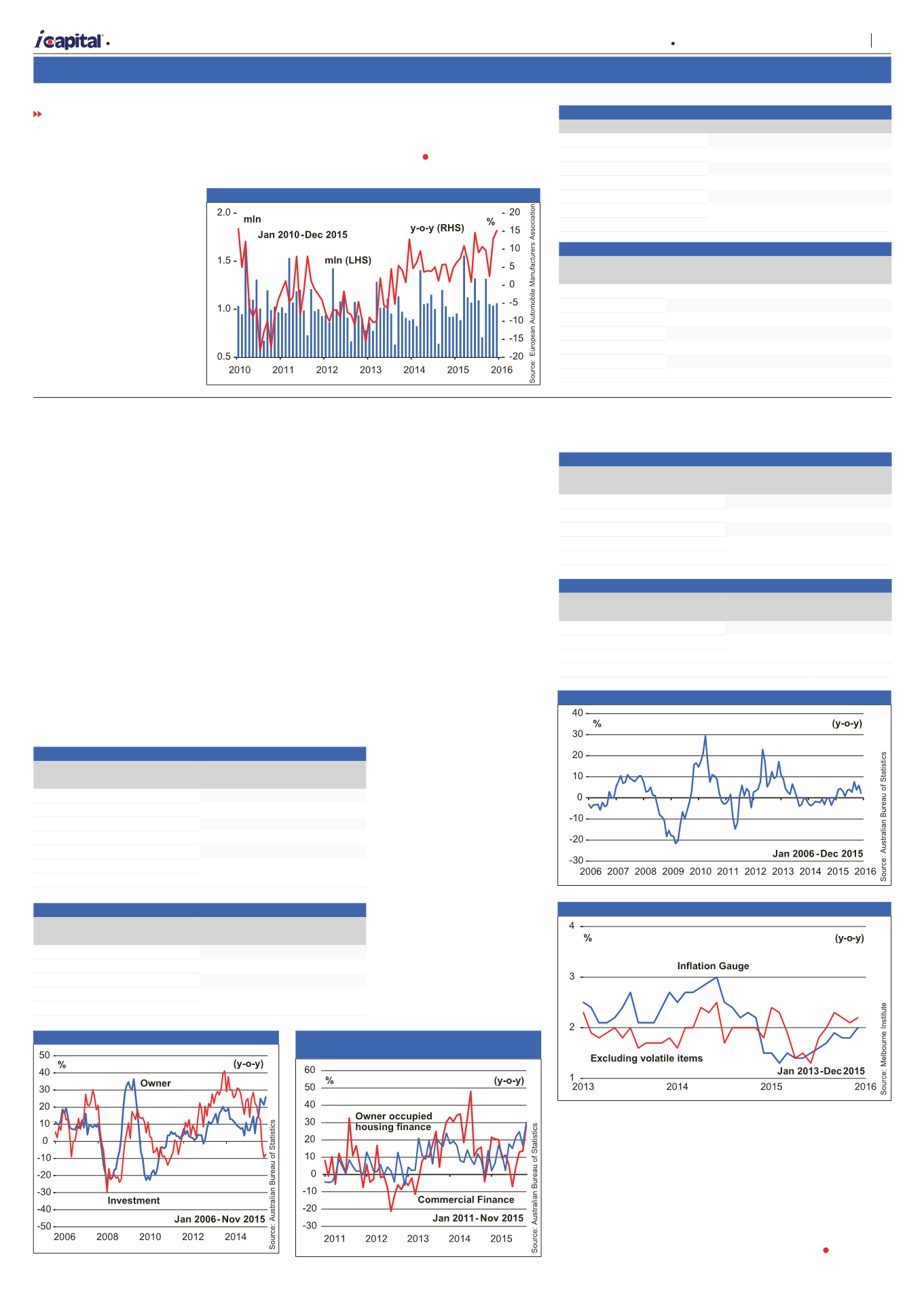

Housing finance

In seasonally adjusted

terms, the total value of

dwelling finance commitments

in Nov grew by 1.8% from

Oct. Investment housing

commitments edged up by

0.7%, while owner-occupied

housing commitments rose

by 2.4% from the preceding

month – see

table 8

.

Year-on-year, the total

value of owner-occupied

housing commitments

jumped by 25.8%, while the

total value of investment

housing commitments fell by

7.7% – see

figure 18

. Going

forward, investment housing

commitments are expected

to continue declining. This

is because all the four major

banks have increased interest

rates for mortgage loans to

cover additional costs arising

from more capital being set

aside to meet regulatory

requirements.

Lending finance

Seasonally adjusted, the

total value of lending finance

commitments in Nov rose by

1.3% from the previous month,

mainly due to gains in owner-

occupied housing finance

and commercial finance

commitments – see

table 9

.

Year-on-year, personal

finance was the only sector

that reported a decline in Nov.

Meanwhile, owner-occupied

housing finance gained 30.1%

in Nov, while commercial

finance commitments

expanded by 28.3% – see

figure 19

.

New motor vehicle sales

In Dec, the sales of new

motor vehicles slipped 0.5%

from Nov in seasonally

adjusted terms, with sports

utility and other vehicle sales

dropping by 1.0% and 6.2%

respectively – see

table 10

. In

trend terms, the sales of motor

vehicles decreased by 0.1%

month-on-month. Year-on-

year, new motor vehicle sales

continued to grow in Dec, but

at a slower pace of 2.2% – see

figure 20

. The increase in car

sales was again due mainly to

the gain in sports utility vehicle

sales.

Inflation gauge

The inflation gauge in Dec

inched up by 0.2% from the

previous month. Excluding

volatile items, the inflation

gauge grew by 0.3% – see

table 11

. Over the twelve

months to Dec, the inflation

gauge increased by 2.0%,

at the lower bound of the

Reserve Bank of Australia’s

2-3% inflation target band.

Core inflation gauge (excluding

volatile items) rose by 2.2%,

year-on-year – see

figure 21

.

Price increases in fruits

and vegetables, holiday

travel & accommodation,

and meat & seafood were

the main contributors to

inflation. However, these

were partially offset by price

falls in fuel, non-alcoholic

beverages and rents. Going

forward, inflationary pressure

is expected to remain subdued

given low energy prices and

weak domestic and global

economic growth.

persistent fall in oil price.

Car sales

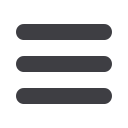

In Dec, new passenger

car registrations in Western

Europe surged, year-on-year,

for the 28th consecutive

month at a faster pace of

15.2% – see

figure 17

. All

of the five major countries

continued to register

growth, with Spain, Italy and

France leading by double-

digit increments in Dec.

Meanwhile, on a month-on-

month basis, new passenger

car sales also rose by 2.4%

FROM PAGE 4

– see

table 7

.

In Jan-Dec 2015,

cumulative new car sales

rose by 8.9% from the same

period last year. Going

forward, new car sales are

expected to continue its

upward trend in the coming

months.

Figure 17 New Passenger Car Registrations

Table 6 Annual Inflation Rate (%)

Oct 2015 Nov 2015 Dec 2015

All items

0.1

0.1

0.2

Energy

-8.5

-7.3

-5.8

All-items excluding energy

1.2

1.0

0.9

Food, alcohol & tobacco

1.6

1.5

1.2

Non-energy industrial goods

0.6

0.5

0.5

Services

1.3

1.2

1.1

Source: Eurostat

Table 7 New Passenger Car Registrations

Car registrations Yearly change (units)

Nov 2015 Dec 2015 Nov 2015 Dec 2015

France

150,334 183,720 15,267 20,366

Germany

272,377 247,355 22,295 17,655

Italy

134,021 109,395 25,475 17,196

Spain

81,650 88,609 16,528 15,169

United Kingdom

178,876 180,077

6,549 13,879

Western Europe

1,038,193 1,063,291 118,681 139,971

Source: European Automobile Manufacturers Association

Figure 18 Owner occupied and investment housing

Table 8 Housing Finance (% change)

From Oct

2015

From Nov

2014

Total dwelling commitments

1.8

11.7

Owner-occupied housing

2.4

25.8

Construction

3.5

3.0

Purchase of new dwellings

-3.4

19.4

Purchase of established dwellings

2.0

27.1

Investment housing

0.7

-7.7

Source: Australian Bureau of Statistics

Table 9 Lending Finance (% change)

From Oct

2015

From Nov

2014

Owner-occupied housing finance

2.4

30.1

Personal finance

0.9

-3.4

Commercial finance

1.1

28.3

Lease finance

-3.9

14.6

Source: Australian Bureau of Statistics

Table 10 New motor vehicle sales (% change)

From Nov

2015

From Dec

2014

Total Vehicles

-0.5

2.2

Passenger vehicles

2.7

-2.0

Sports utility vehicles

-1.0

13.4

Other vehicles

-6.2

-5.7

Source: Australian Bureau of Statistics

Table 11 Inflation Gauge (% change)

From Nov

2015

From Dec

2014

Total

0.2

2.0

Excluding volatile items*

0.3

2.2

* Volatile items are automotive fuel, fruits, and vegetables

Source: Melbourne Institute

Figure 20 New motor vehicle sales

Figure 21 Inflation Gauge

Figure 19 Commercial and Owner Occupied

Housing Finance Commitments

A

| Market Opinion

5

Capital Dynamics Sdn Bhd

The week of 21 January – 27 January 2016

Volume 27 Number 21