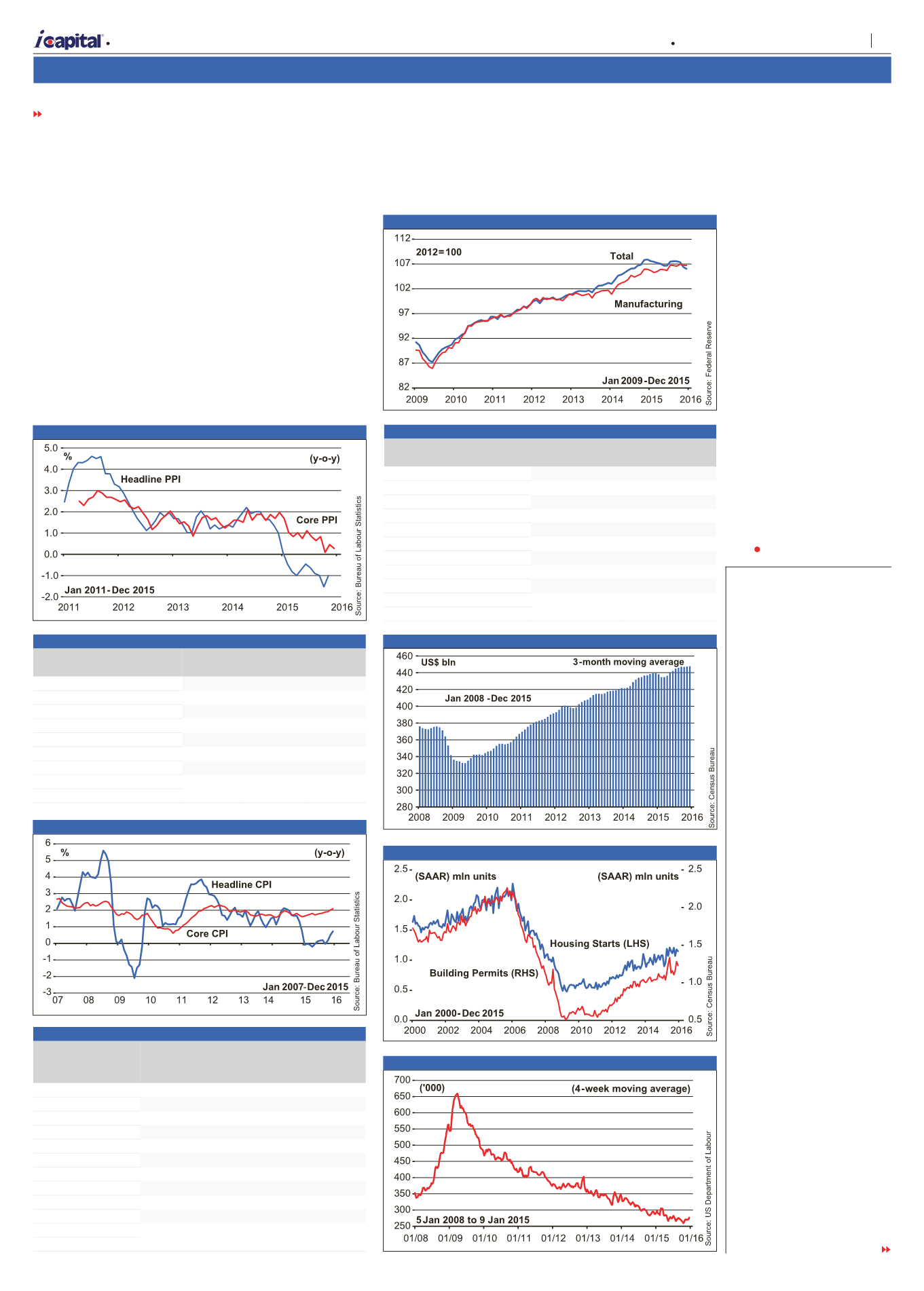

Consumer price index

The headline CPI in Dec

fell 0.1% from the previous

month. Excluding the food and

energy components, the core

CPI edged up by 0.1%, the

smallest increase since Aug

2015 – see

table 3

. Year-on-

year, the headline CPI rose

by 0.7%, while the core CPI

gained 2.1% – see

figure 3

.

Industrial production

In Dec, industrial

production fell by 0.4% from

Nov. Industrial production has

been falling consecutively for

the third month as a result

of lower utilities output – see

table 4

. The overall industry

capacity utilisation rate also

declined from 76. 9% in

Nov to 76.5% in Dec. On a

year-on-year basis, industrial

production fell by 1.8%.

The moderation reflects the

effect of unseasonably warm

weather, a strong US$ and low

oil prices – see

figure 4

.

Retail sales

In Dec, retail sales fell by

0.1%, month-on-month, mainly

due to a decline in sales at

gasoline stations and an

unseasonably warm weather –

see

table 5

. On a year-on-

year basis, retail sales rose by

2.2% – see

figure 5

.

China

GDP

China’s real GDP in 4Q

2015 rose 6.8%, year-on-

year – see

figure 8

. Growth

was sustained mainly by firm

private consumption amidst

falling exports and slowing

investment activities. For

the whole of 2015, China’s

economy grew 6.9% from

2014, the first below 7%

growth since 1990, but was

in line with the government’s

target of around 7%. Given

the fluid conditions at the

moment,

i

Capital’s forecast

for China’s real GDP growth

in 2016 is in a wide range of

4.5-6.5%.

Industrial production

In Dec, industrial

production rose by 5.9%,

year-on-year. The slower

growth rate was mainly due

to a 3.7% contraction in

electricity output, which in

turn was affected by a warmer

weather condition. Given the

weak new orders received,

manufacturing activity

would still face considerable

downward pressure going

forward – see

figure 9

.

In 2015, industrial output

rose by 6.1% from 2014.

Retail sales

In Dec, retail sales rose

by 11.1% from a year ago.

FROM PAGE 2

Housing starts

Housing starts in Dec fell

2.5%, month-on-month, but

rose 6.4%, year-on-year, to a

seasonally adjusted annual

rate (SAAR) of 1.149 mln

units. Housing starts have

exceeded 1 mln units for

the 9th consecutive month,

the longest stretch since Apr

2008 – see

figure 6

. The

number of single-family and

multi-family housing units

under construction fell 3.3%

and 3.4%, month-on-month,

respectively. Year-on-year,

single-family housing starts

increased 6.1% to a SAAR

of 768,000 units, while

multi-family housing starts

increased 8.6% to 365,000

units. Meanwhile, building

permits, an indication of future

activity, fell 3.9% from Nov, but

rose 14.4% from a year ago to

a SAAR of 1.232 mln units.

Initial claims

The seasonally adjusted

initial claims for the week

ending 9 Jan 2016 were

284,000, up 7,000 from the

previous week. The 4-week

moving average increase

by 3,000 from the previous

week to 278,750 – see

figure

7

. Continuing jobless claims

for the week ending 2 Jan

2016 registered a seasonally

adjusted 2.263 mln, up 29,000

from the previous week; the

4-week moving average

increased by 5,250 to 2.224

mln.

TURN TO PAGE 4

Table 3 Consumer Price Index (% change from the prior month)

Oct

2015

Nov

2015

Dec

2015

All Items

0.2

0.0

-0.1

All items less food and energy

0.2

0.2

0.1

Energy

0.3

-1.3

-2.4

Food

0.1

-0.1

-0.2

Apparel

-0.8

-0.3

-0.2

Shelter

0.3

0.2

0.2

Transportation

0.2

0.6

0.3

Medical care

0.8

0.4

0.1

Source: Bureau of Labour Statistics

Table 4 Industrial Production

% change from

the prior month

% change

from

Oct 2015 Nov 2015 Dec 2015 Dec 2014

Total industry

-0.2

-0.9

-0.4

-1.8

Major market groups

Final products

-0.3

-0.7

-0.5

-1.2

Consumer goods

-0.2

-0.6

-0.8

0.3

Business equipment

-0.4

-1.0

0.1

-0.8

Construction

2.2

0.0

0.6

1.6

Materials

-0.5

-1.2

-0.3

-3.1

Major industry groups

Manufacturing

0.4

-0.1

-0.1

0.8

Mining

-2.0

-2.1

-0.8

-11.2

Utilities

-1.8

-5.0

-2.0

-6.9

Source: Federal Reserve

Table 5 Retail Sales (% change)

Change from

prior month

Change from

prior year

Total

-0.1

2.2

Ex-auto & parts

-0.1

1.2

Motor vehicles & parts

0.0

6.1

Furniture & home furniture

0.9

6.0

Electronics & appliance

-0.2

-3.8

Food & beverages

-0.3

1.2

Health & personal care

0.2

3.6

Gasoline stations

-1.1

-14.6

Clothing & clothing accessories

-0.9

0.6

General merchandise

-1.0

0.1

Source: Census Bureau

Figure 2 Producer Price Index

Figure 3 Consumer Price Index

Figure 4 Industrial Production Index

Figure 6 Housing Starts and Building Permits

Figure 7 Initial Claims

Figure 5 Retail Sales

A

| Market Opinion

3

Capital Dynamics Sdn Bhd

The week of 21 January – 27 January 2016

Volume 27 Number 21