A Small Hiccup

What a start to 2016 !

In response to the sharp

upheaval in the stock market

last year, China introduced

the circuit breaker mechanism

to control extreme volatility.

The mechanism

was triggered as

soon as it came

into effect on 1

Jan 2016, and

then again 3 days

later. Eventually,

the circuit

breakers had to

be suspended.

Unfolding at

the same time

as the stock

market turmoil

was the volatility

of the Renminbi’s

exchange

rate, which led

the Chinese

government to intervene

heavily to support the

currency. The dramatic

developments in China’s

stock and currency markets,

compounded with fears over

her economic conditions,

and the Western media’s

sensationalistic coverage of all

these events sent shockwaves

around the world. Together

with Federal Reserve belated

rate hike in Dec 2015, a few

trillion dollars were wiped off

the global stock markets within

the first two weeks of trading.

The US caused the 2008

global financial crisis, from

which the US, Europe and

Japan have yet to recover;

now, it is feared that events

unfolding in China will spark

another global economic crisis

in 2016. What is on investors’

worry lists regarding China’s

economy and how likely are

these worries to become a

nightmare for both Chinese

and global economies ?

First, China’s exports

contracted every month in

2015 except in Feb and

Jun. On 11 Aug 2015, China

announced an adjustment

in the quotation mechanism

of the Renminbi’s central

parity rate. In response, the

Renminbi lost about 3%

against the US$ in 2 days. On

7 Jan 2016, the central parity

rate was fixed at a level that

was the lowest in 4 years.

This immediately stoked fears

that China is weakening the

Renminbi to aid her exports,

which could spark a currency

war. What was not reported in

the media is the fact that until

recently the Renminbi has

been the strongest currency in

the world.

On a related note, it was

revealed that China’s foreign

exchange reserves dropped

to US$3.33 trillion in Dec

2015, the lowest level since

Dec 2012 – see

figure 3

. The

reserves level has been falling

for 13 of the past 15 months,

indicating capital outflow and

the amount China has spent to

support the Renminbi. China

still has the highest reserves

level in the world. However,

with rising US interest rates

and the prevailing expectation

that the Renminbi will remain

on a downtrend due to

slower economic growth, it is

feared that China’s

reserves may not be

sufficient to defend

the Renminbi. What

was also not reported

in the media is the

fact that the Federal

Reserve has been

adopting a zero

interest rate policy

for 8 years. With the

Renminbi tied to the

US$, carry trade in

Renminbi was active

and lucrative. Now the

reverse is happening.

Secondly, on

the list is China’s

high debt level.

After years of high

investment growth, China

has accumulated one of the

highest corporate debt levels

in the world. Given China’s

slowing economy and falling

corporate profits, her corporate

debt level could deteriorate

further. This would, in turn,

heighten the risk of defaults,

bankruptcies, and banking and

economic crises.

Third comes Japan-style

problems. China is

experiencing excess capacity

in her heavy industry as well

as her property sector. With

global commodity prices

plunging, China like many

other countries is facing

deflationary problems at the

producer level. This, coupled

with the high debt level,

reminds people of what Japan

was facing which eventually

led to her losing multiple

decades. What was also

not reported in the media is

the fact that Japan has not

reformed an iota in the last

25 years. The reforms that

China is undertaking in one

5-year plan is more than all

of the reforms that Japan

has attempted in the last 3

decades.

Fourthly, the Chinese

government is losing control.

In the past, the Chinese

government always seemed

to have a firm hold over the

economy. It was generally

able to steer its direction

and manage the pace of

China’s economic expansion.

However, the recent volatility

in China’s stock and currency

markets that occurred

despite heavy government

intervention indicate that it

may be losing its grip over the

economy. It almost seems as

if the Chinese economy is in

deeper trouble than people

think and that there is nothing

the Chinese government can

do about it. What was also

not highlighted correctly in

the Western media is the

unprecedented reform based

on the anti-corruption drive.

The media has incessantly

portrayed president Xi

Jinping’s anti-corruption drive

as a political power grab.

The anti-corruption campaign

has gone on for years and

is conducted at all level and

in all corners of the nation. A

Chinese government losing

control would not be able to

implement this unprecedented

anti-corruption drive, let alone

sustain it for so long.

Given that China is the

second largest economy in

the world, the world’s largest

trading nation, and the

biggest consumer of many

commodities, a hard landing in

China would be catastrophic.

It would drag down many

economies, both developed

and developing. However,

while all of the aforementioned

worries are legitimate, there

are also mitigating factors.

One, short term exchange

rate movements are typically

volatile, in which sentiment

usually plays an overriding role

in determining them. However,

in the longer term, the trend

of an exchange rate always

reflects a country’s economic

fundamentals. After the dust

settles, investors will once

again focus on China’s strong

economic fundamentals,

political stability and huge

potential. Raghuram Rajan,

India’s respected central bank

governor, said in a recent

Bloomberg interview, “My

sense is there is underlying

growth in China ……… It’s not

falling off a cliff.”

Two, China does not

deny that the rapid increase

“The media has incessantly

portrayed president Xi Jinping’s

anti-corruption drive as a

political power grab. The

anti-corruption campaign

has gone on for years and is

conducted at all level and in

all corners of the nation. A

Chinese government losing

control would not be able to

implement this unprecedented

anti-corruption drive, let alone

sustain it for so long.”

China on the move

On 18 Mar 2004,

i

Capital started an exclusive section on China, an

immensely important, huge, and complex nation. As our managing

director described it, the emergence of China is an event that

happens only once in a millennium. Tracking its fast emergence and

understanding its development will be useful not only for investors but

also for businessmen and management. This exclusive series “China

on the move” started with “A Brief History of China”, made up of 8

parts, started with the Xia Dynasty (

夏朝

) and rounded up by examining

Deng’s reforms.

China Today

China today is the world’s most exciting, dynamic, and successful

economy. What drove China’s phenomenal growth in the past few years

? In the previous parts of China Today, we examined her economic

structure, sources of growth, the current conditions, and her future.

Source: Capital Dynamics

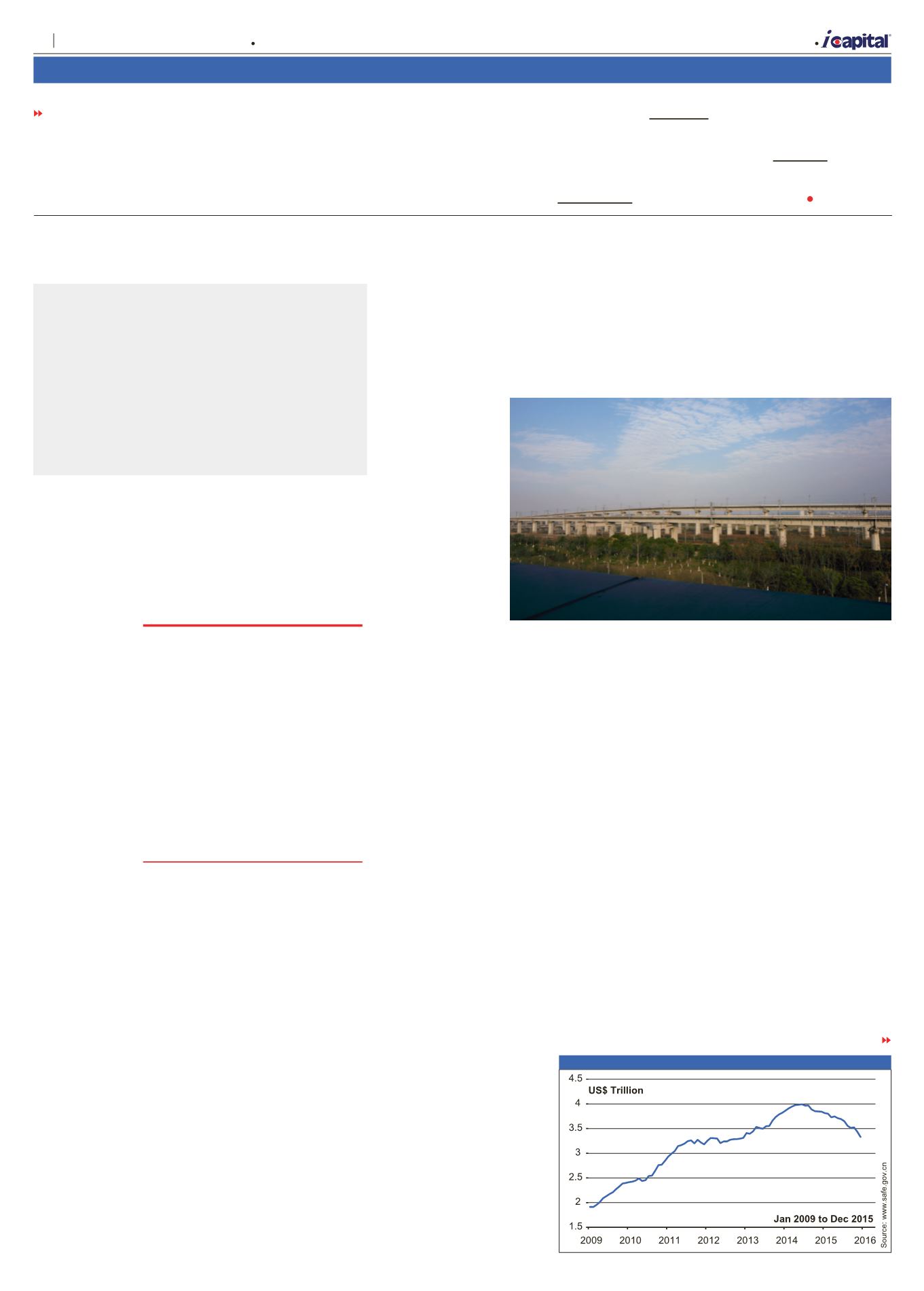

High speed train to Nanjing symbolizing China’s

successful economic transformation.

see that China’s Renminbi,

previously tied to the US$,

has been appreciating

for years while the major

competing currencies have

been devaluing precipitously

and there needs to be an

adjustment.

For the Hong Kong stock

market, unfortunately, the

frank and objective opinions

of Rajan do not help. What

i

Capital has been warning

about Hong Kong and the

Hang Seng remain. The

coming recession for Hong

Kong will be prolonged and

the recovery will be weak,

unlike the 2009 V-shaped

FROM PAGE 7

TURN TO PAGE 9

recovery. For the

short-term

,

i

Capital revises its bearish

outlook of the Hong Kong

stock market to a range from

15,000 to 20,000. See Stop

Press for the latest. For the

medium-term

,

i

Capital

retains its bearish outlook

of the Hang Seng Index at a

range from 10,000 to 20,000.

For the

long-term

outlook,

i

Capital will review it at a

later stage but it needs to go

to 15,000 first.

Figure 3 China’s Foreign Exchange Reserves

A

| Market Opinion

8

Capital Dynamics Sdn Bhd

The week of 21 January – 27 January 2016

Volume 27 Number 21