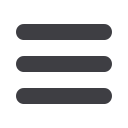

After factoring out the price

factor, real retail sales rose

by 10.7%, year-on-year –

see

figure 10

. The steady

performance in retail sales is

reassuring. Domestic demand

FROM PAGE 3

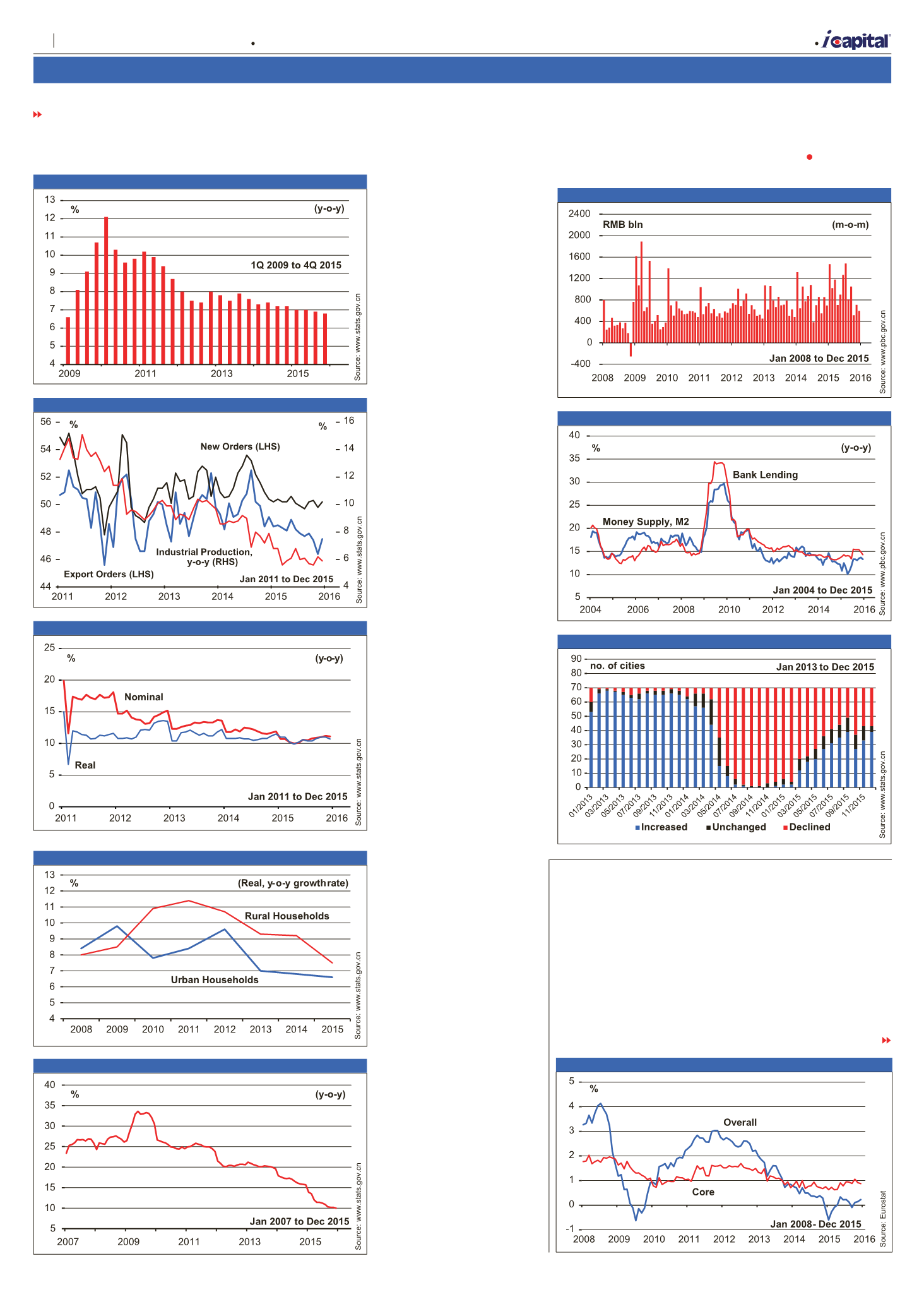

Inflation

In Dec, the annual inflation

rate edged up to 0.2% – see

figure 16

. On the other hand,

excluding energy, the inflation

rate dipped slightly to 0.9%

– see

table 6

. The higher

cost of restaurants & cafes,

Europe

is still providing stable support

to China’s economy.

In 2015, retail sales rose

by 10.7% from 2014.

Household income

Household income

continued to grow steadily

in 2015, rising 8.9% from

2014. Factoring out the price

effects, household income

grew by 7.4%, faster than

the real GDP growth rate.

Urban household per capita

disposable income rose 8.2%

to RMB31,195, while the per

capita cash income of rural

households expanded 8.9%

to RMB11,422. Factoring out

the price effects, urban and

rural household per capita

income rose 6.6% and 7.5%

respectively. Affected by

falling commodity prices,

rural household income rose

at a substantially slower

pace in 2015. However,

urban household income

growth was relatively stable,

indicating a stable labour

market – see

figure 11

.

Fixed asset investment

Fixed asset investment

(excluding rural households)

in Jan-Dec 2015 rose 10.0%

from the same period a

year ago, slowing from the

10.2% expansion in Jan-Nov

2015 – see

figure 12

. While

industrial excess capacity

is suppressing investment

expenditure, lately, monetary

and fiscal policies have been

supportive for a stronger

investment growth, thus the

downtrend in fixed asset

investment expansion should

stabilise soon.

Bank lending

Renminbi bank loans

outstanding at the end of

Dec were RMB93.95 trillion,

up 14.3% from a year ago.

New bank loans totalling

RMB597.8 bln were created

in Dec. The slowdown in

credit growth reflects slowing

economic activities – see

figure 13

. In 2015, RMB11.72

trillion new bank loans

were created, RMB1.81

trillion more than in 2014, a

moderate increase.

Money supply

The annual growth rate of

money supply, M2, at the end

of Dec slowed to 13.3%. This

reflects slowing economic

activities – see

figure 14

.

House prices

The housing sector

continued to recover in

Dec, especially in the first

tobacco, and vegetables

were again partially offset by

falls in the prices of fuels for

transportation, heating oil,

and gas. Inflationary pressure

is expected to remain weak in

the months ahead due to the

TURN TO PAGE 5

and second tier cities. The

number of cities reporting

month-on-month increases

in house prices rose from 33

in Nov to 39 in Dec, while

the number of cities reporting

declines in house prices

remained unchanged at 27 –

see

figure 15

.

Figure 8 China’s Real GDP

Figure 9 Industrial Production and Manufacturing Orders

Figure 10 Retail Sales

Figure 11 Household Income Per Capita

Figure 12

Cumulative Fixed Asset Investment (Excluding rural house

holds)

Figure 13 Renminbi Bank Loans

Figure 14 Money Supply and Bank Lending

Figure 15 Month-on-month Change in House Prices

Figure 16 Annual Inflation Rate

A

| Market Opinion

4

Capital Dynamics Sdn Bhd

The week of 21 January – 27 January 2016

Volume 27 Number 21